Glass half full?

A new report launched today documents the hurdles communities and workers face in obtaining remedy from development banks whose projects cause them harm. The 11 civil society organizations that authored the report, Glass Half Full? The State of Accountability in Development Finance, call on development banks and the governments that run them to strengthen their systems for providing remedy to those harmed by the activities financed by the banks.

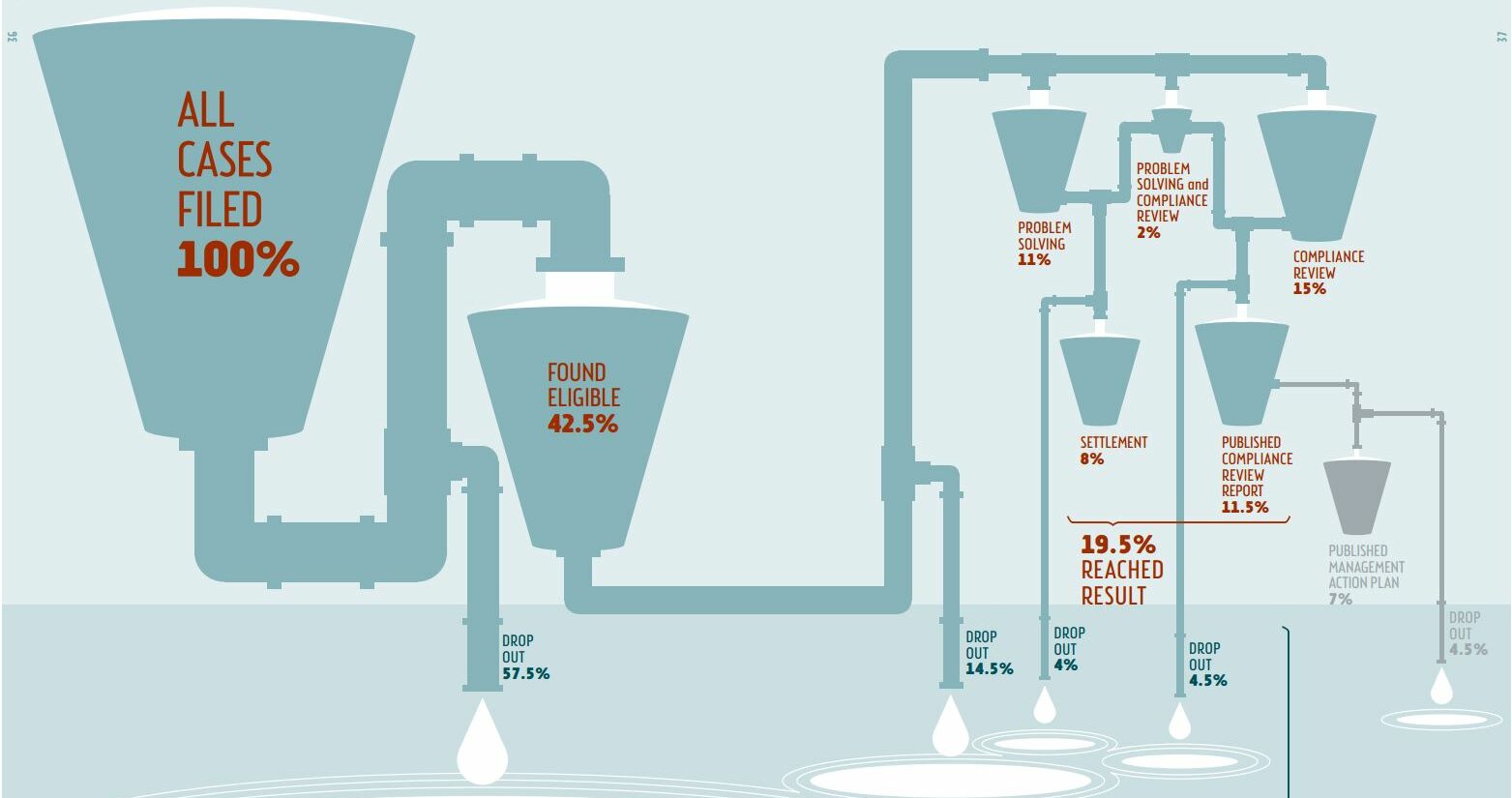

As a result of pressure from civil society, many development banks have established independent accountability mechanisms—also called complaint mechanisms—that receive complaints from communities and workers adversely affected by bank-financed activities. While the structure and procedures of these mechanisms vary between banks, they can offer to convene the complainants and the borrower (the bank’s client) to resolve the conflict, conduct an investigation to determine if the bank’s environmental and social policies have been violated, or both.

The complaint mechanisms are often the only available recourse for communities harmed by development projects and currently represent the only avenue to hold development banks accountable to their environmental and social commitments.

Since the 1994 creation of the World Bank’s Inspection Panel—the first independent accountability mechanism, there have been 758 complaints filed to the mechanisms at 11 development banks. ‘Glass half full?’ assesses the extent to which the development banks and their complaint mechanisms are equipped to handle complaints from affected people.

Findings

What the report finds is that even though complainants are undoubtedly better off than they would be in the absence of any complaint procedure, the outcome rarely provides adequate remedy for the harms experienced by people and communities. This is largely due to the development banks themselves, which undermine the effectiveness of their own complaint mechanisms by limiting their mandate and failing to uphold their own responsibilities in the complaint process. The banks impede the accessibility and effectiveness of the complaint mechanisms from the very beginning by failing to require their borrowers to tell project-affected people about their existence. Even more critically, the banks have limited the mandates of the mechanisms so that they cannot issue binding decisions. Rather, the outcome of complaints depends primarily on the good will of the banks or their borrowers: unless governments and companies voluntarily agree to resolve the conflict through dialogue, or the bank voluntarily agrees to address violations of its policies exposed through an investigation conducted by the mechanism, complainants are left without a solution.

Case Studies

The case studies in the report illustrate how the existing system at development banks falls short:

- One case investigated by the Compliance Advisor Ombudsman (CAO)—the complaint mechanism of the International Finance Corporation (IFC)— found that the IFC failed to address its client’s disregard for workers’ rights to freedom of association, but the issues that led to the complaint remain. “The company’s practices that were documented when the complaint was submitted, continue today and workers’ rights are still not being respected,” says Peter Bakvis, one of the complainants in the case.

- Complainants who brought a case to the Independent Complaints Mechanism (ICM) of the Dutch and German development banks were similarly disappointed with the response they received from the banks. While satisfied with the ICM’s investigation report of the risks posed by the Barro Blanco hydroelectric dam in Panama, Manolo Miranda, one of the complainants’ representatives, notes: “Nothing has changed… the banks and the company have done nothing to prevent the impacts on our culture, territory and religion.”

- In the Bujagali complaint, also handled by the CAO, the complainants attribute the company’s willingness to negotiate with them to the involvement of the CAO, but ultimately they were unsatisfied with the result of the negotiations. Recognizing that the CAO did not have the mandate to compel the company to provide fair compensation to affected community members, the complainants felt they had no choice but to agree to the terms offered by the company.

Recommendations

The report includes a number of best practice recommendations that should be adopted at all development banks. However, it concludes that meaningful remedy for complainants and prevention of future harms will require more than best practices. A new accountability system must be established as a matter of urgency, with complaint mechanisms empowered to make binding decisions on banks and their borrowers, and an end to immunity for development banks in national courts.

Download

Download the report Glass Half Full? and its annexes here.

Partners

-

FUNDEPS – Foundation for the Development of Sustainable Policies

Related content

-

Glass Half Full? Published on:

Kristen GenovesePosted in category:Publication

Kristen GenovesePosted in category:Publication Kristen Genovese

Kristen Genovese

-

The Patchwork of Non-Judicial Grievance Mechanisms Published on:

Kristen GenovesePosted in category:Publication

Kristen GenovesePosted in category:Publication Kristen Genovese

Kristen Genovese

-

-

Illegal closing Barro Blanco dam puts native lands under waterPosted in category:NewsPublished on:

Illegal closing Barro Blanco dam puts native lands under waterPosted in category:NewsPublished on: