Shadow banking and tax avoidance

Since the start of the financial crisis, various international fora such as the G20 and the OECD discussed tackling the risks of the shadow banking system. This financial system consists of the issuance and trading of credit outside of the regulated banking system. It operates parallel to the conventional system. Because of the interdependence between the two banking systems, systemic risks in the shadow banking sector are also risks to the regular banking system.

The SOMO publication ‘Schaduwbankieren en belastingontwijking‘ (Shadow banking and tax avoidance) outlines the problematic nature of the shadow banking system and highlights the Dutch role within it.

The crucial problem of the shadow banking system is, that it cannot rely on guarantees and liquidity support from the central banks. Systemic risks are therefore very difficult to control, while they pose a very real risk for the regulated banks, as became clear in 2008. Furthermore, shadow banking entities concentrate in so called tax havens, where there is no direct supervision.

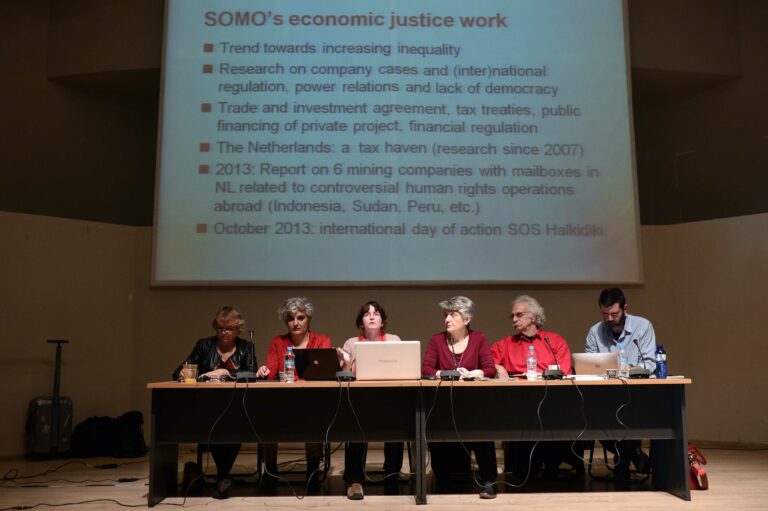

The Netherlands play a special role in the global shadow banking system, due to its tax legislation and its large trust sector. In the Netherlands, financial institutions use the same legislation and tax infrastructure that multinationals use for tax avoidance. “The practices of shadow banking and tax evasion are coming together in the Netherlands and therefore the debate should also be about the two together and the risks they entail. “The question is what interest should be served, that of tax avoidance or that of financial stability”, says SOMO-researcher Rodrigo Fernandez.

The SOMO publication ‘Schaduwbankieren en belastingontwijking‘ is only available in Dutch.

Do you need more information?

-

Rodrigo Fernandez

Senior researcher

Related content

-

-

-

-

-

The Netherlands lags further behind in tackling tax avoidancePosted in category:NewsPublished on:

The Netherlands lags further behind in tackling tax avoidancePosted in category:NewsPublished on: -