Financial agricultural markets deserve more attention in financial reforms

On the eve of the meeting of the G-20 Ministers of Finance in Washington on 23 April, SOMO is publishing Financing Food. Financialisation and Financial Actors in Agriculture Commodity Markets. The study focuses on how derivative markets and financial speculation in agricultural commodities work. SOMO demonstrates how the futures market for agricultural products, in particular, has changed and is being disrupted by new speculators, growing index funds and commodities funds. This can have an influence on food prices, which can rise as a result, making food too expensive for the poor in developing countries.

The study also shows how a number of large banks and investment banks, such as Goldman Sachs, Bank of America and Deutsche Bank, control a wide range of functions in the derivatives trade and are a driving force behind the financial speculation. These banks made huge profits and paid huge bonuses in 2009, partly as a result of the trade in derivatives, of which food derivatives formed a part.

SOMO closes the briefing with a few proposals for reforms of the financial markets for agricultural products, in order to prevent all excessive speculation. Up to now, the derivatives trade has remained largely unregulated. New laws are being drawn up in the US, the subject has long been on the agenda for the G-20, and the EU is preparing new legislation.

“When there is increasing financial speculation on agricultural commodities , the profits go primarily to speculators, such as hedge funds and large banks," according to SOMO researcher Myriam Vander Stichele. "With the financial reforms currently taking place, we must take the opportunity to tackle all forms of speculation which are not to the benefit of sustainable agriculture and accessible food prices."

Download publication ‘Financing Food. Financialisation and Financial Actors in Agriculture Commodity Markets’

Related news

-

Hungry for profits Published on:

Vincent KiezebrinkPosted in category:Publication

Vincent KiezebrinkPosted in category:Publication Vincent Kiezebrink

Vincent Kiezebrink

-

Modern slavery is still lurking in your coffee cupPosted in category:News

Modern slavery is still lurking in your coffee cupPosted in category:News Joseph Wilde-RamsingPublished on:

Joseph Wilde-RamsingPublished on: -

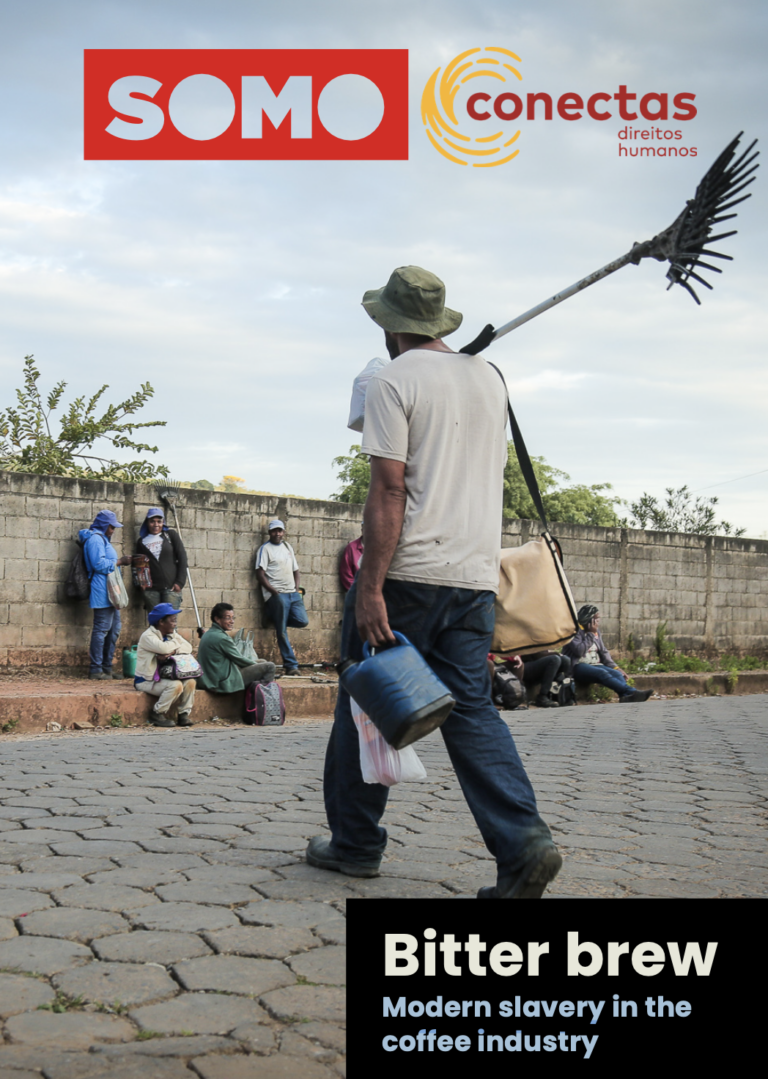

Bitter brew Published on:Posted in category:Publication