Private Gain, Public loss

Mailbox companies, tax avoidance and human rights

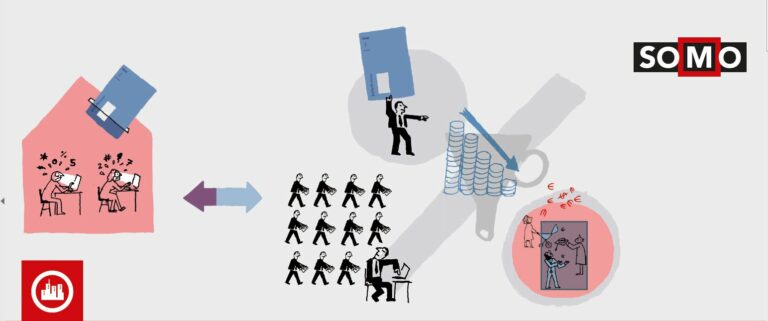

This report examines the human rights record of eight extractive industry companies incorporated in the Netherlands and discusses the Dutch states responsibility regarding the human rights of the people affected by these business enterprises. We focus on two distinct but related areas in which extractive MNCs impact human rights: (1) MNCs avoiding taxes and the destructive loss of revenue that could have been used for the state duty to fulfill human rights and (2) the negative human rights impact resulting from companies operational activities, namely the extraction of resources. The Netherlands is one of the biggest players in the international tax avoidance industry. The country hosts 23,500 mailbox companies typically used for fiscal planning. Most of the worlds largest extractive companies maintain financial holding companies in the Netherlands that have ownership and/or control relationships with operations in several high-risk environments. This research shows that the nature of business activities and company structures of extractive industry companies in the Netherlands point to tax avoidance and related revenue losses in poor countries. This undermines obligations of host states to protect and fulfill human rights. Second, all researched MNCs have been involved in human rights controversies in countries of operation. As a home or conduit state that offers direct parents and holding companies of subsidiaries associated with these human rights controversies investment protection and fiscal benefits, the Netherlands has a responsibility to address these violations by trying to prevent this structural problem and provide access to justice for its victims. The report concludes that the Netherlands fails to regulate the human rights impact of MNCs located in its territory. The Dutch state should proactively introduce (legal) measures to prevent the negative footprint of these companies abroad, and provide remedy to victims of corporaterelated abuses.

Partners

-

SOMO

Publication

Accompanying documents

Related content

-

Big Companies, Low Rates Published on:

Indra RömgensPosted in category:Publication

Indra RömgensPosted in category:Publication Indra Römgens

Indra Römgens

-

Fifty shades of tax dodging Published on:

Indra RömgensPosted in category:Publication

Indra RömgensPosted in category:Publication Indra Römgens

Indra Römgens

-

Mark van DorpPosted in category:Publication

Mark van DorpPosted in category:Publication Mark van Dorp

Mark van Dorp

-

Tax-free profits Published on:

Roos van OsPosted in category:Publication

Roos van OsPosted in category:Publication Roos van Os

Roos van Os

-

-

-

-

Hidden profits Published on:

Indra RömgensPosted in category:Publication

Indra RömgensPosted in category:Publication Indra Römgens

Indra Römgens