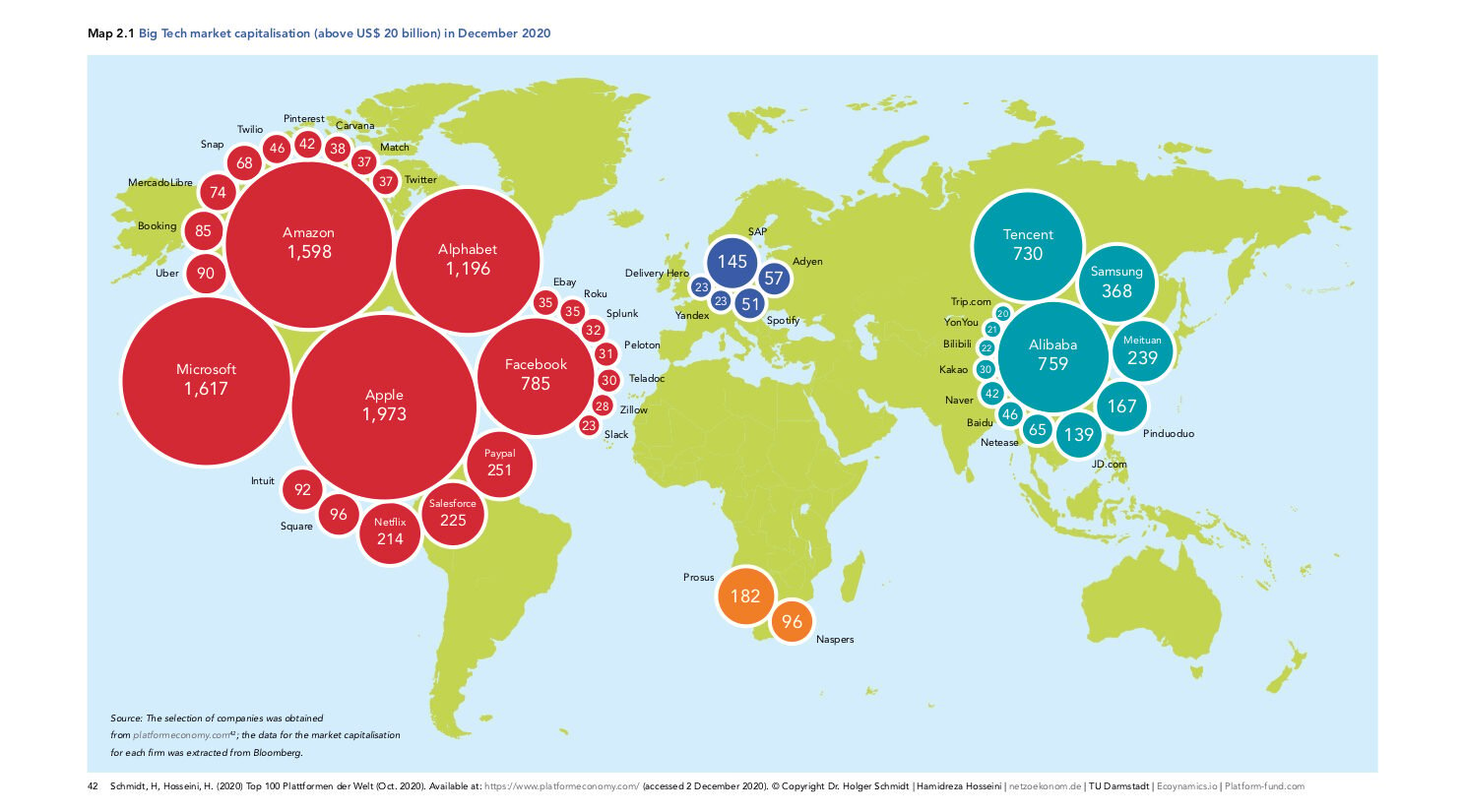

COVID-19 pandemic accelerates the monopoly position of Big Tech companies

The covid-19 pandemic will be yet another powerful catalyst that will deepen the power of Big Tech companies. Research on the business models of Alphabet (Google), Apple, Amazon, Facebook, Microsoft, Alibaba and Tencent shows how the 2008 financial crisis already accelerated the trend towards market consolidation. The present crisis is likely to do the same, say researchers in this new report, that zooms in on ‘the apex of capital accumulation at the frontier of capitalist development’.

-

The financialisation of BigTech (pdf, 2.33 MB)

Big Tech corporations stand out compared to other sectors according to most indicators presented in this report. Compared to the S&P 500 corporations, they have more financial assets at their disposal and follow a business model that relies more strongly on intangible assets such as patents and goodwill. The increasing value of goodwill on the balance sheet of Big Tech firms points to the accumulated premiums paid for companies acquired in the race to the economic heights of monopoly power.

Big Tech’s combined financial assets stood at a staggering US$740 billion, on top of combined total debt of US$295 billion. These financial resources (assets and debt) are primarily used to acquire other technology firms and enter other sectors. In October 2020, Apple, Microsoft, Amazon and Alphabet had each crossed the threshold of US$1 trillion market capitalization. The report states:

“This all shows that the financial fire power of our Big Tech firms is unrivaled, and that the chances of new applications and platforms to ‘grow up’ and to remain independent are increasingly limited” says SOMO-researcher Ilke Adriaans.

The underlying economic principles suggest a ‘winner-take-all’ logic. In this scenario, a corporation that owns an exclusive asset, such as a platform, can command rent income from ownership and operations rather than production. This rent income, a result of a monopolised platform, is in turn further augmented or leveraged through financialised techniques.

“The developments we see in Big Tech are very similar to the period called the Gilded Age in the 19th century when massive investments in US railroads gave rise to monopolies in banking, oil and steel. Marc Zuckerberg, Jeff Bezos and Jack Ma can easily be compared to the former ‘Robber Barons’ John P. Morgan, John D. Rockefeller and Andrew Carnegie”, says SOMO-researcher Rodrigo Fernandez.

Key facts from the report

- The 2008 Financial crisis was a catalyst for market consolidation

- Total debt increased from US$1 billion in 2007 to US$295 billion in 2019

- Financial assets increased from US$67 billion in 2007 to US$740 billion in 2019

- The value of goodwill (excluding Apple) increased from US$7 billion in 2007 to US$149 billion in 2019

- The 7 Big Tech firms in this report had a total of 310 subsidiaries in tax havens like Hong Kong, Ireland and the British Virgin Island

- Between 2015-2019, the 7 companies in this report paid over US$144 Billion in employee compensations through share-based compensations

Do you need more information?

-

Rodrigo Fernandez

Senior researcher

Related content

-

The financialisation of Big Tech Published on:

Rodrigo FernandezPosted in category:Publication

Rodrigo FernandezPosted in category:Publication Rodrigo Fernandez

Rodrigo Fernandez

-

The earnings model of the pharmaceutical industry needs to be overhauledPublished on:Posted in category:Opinion

-

We Can’t Afford Big Pharma’s GreedPosted in category:Opinion

Rodrigo FernandezPublished on:

Rodrigo FernandezPublished on: Rodrigo Fernandez

Rodrigo Fernandez -

Private gains we can ill afford Published on:

Rodrigo FernandezPosted in category:Publication

Rodrigo FernandezPosted in category:Publication Rodrigo Fernandez

Rodrigo Fernandez

-