Why the IIF is unlikely to help poor countries with debt relief

UN Secretary General Guterres and world leaders sounded the alarm on debt payments last week at a high-level UN meeting. There are too many high debt payments which are diverting money needed by poorer countries to tackle the pandemic, its economic downturn, climate change and the UN sustainable development goals (SDGs).

At their meeting of 7 April 2021, the G20 will have to recognize that their initiative to tackle that problem has had too little effect. Last year in April, the poorest countries were offered ways and conditions to suspend servicing their debt during the pandemic: the Debt Servicing Suspension Initiative or DSSI. Since many poor countries’ debts are increasingly owed to private creditors, the G20 had “call[ed](opens in new window) on private creditors, working through the Institute of International Finance (IIF), to participate in the [DSSI] on comparable terms” to those of the public creditors and on a voluntary basis. The G20 then worked closely with the Institute of International Finance.

However, when meeting on 14 October 2020, the G20 Finance Ministers and Central Bank Governors stated that they were “disappointed by the absence of progress of private creditors’ participation in the DSSI”. Indeed, an important part of the money that was freed up, granted or lent, went to servicing debt to private creditors such as banks and bond holders. For instance, IMF Covid-19 loans in 2020 to poorest countries amounted to US$ 42.9 billion, but 47.3% was used to pay private creditors(opens in new window) . In other words, the private creditors through the IIF had not delivered and payment to private creditors still continues.

Privileged role

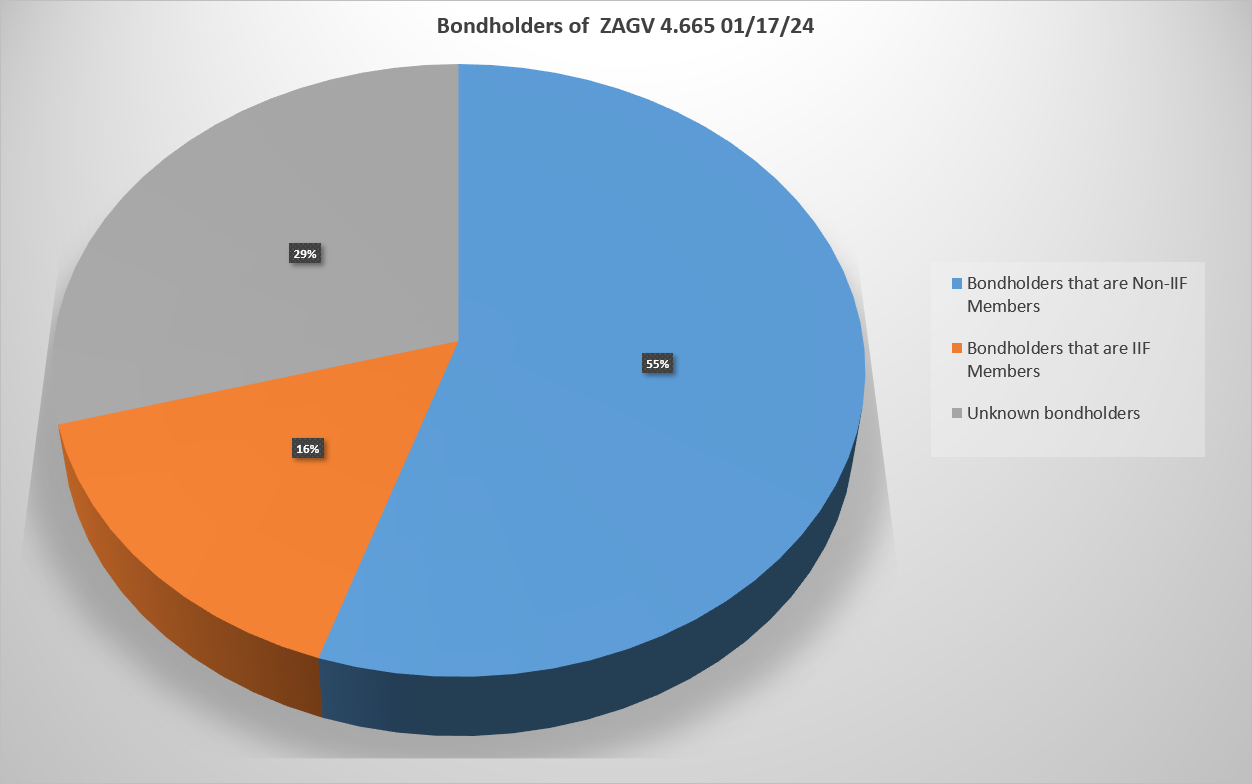

What is the Institute of International Finance(opens in new window) and why was it given a privileged role in the G20 debt initiative? SOMO has started to research the IIF’s role and influence. The IIF is the largest global industry association and lobby club of the private financial industry. Its members cover all activities in the private debt market, such as the banks who are providing loans (including Chinese banks), investment banks underwriting bonds, credit rating agencies rating loans and bonds, as well as institutional investors and fund managers who are buying the bonds. Still, many private creditors of developing countries are not members of the IIF, as illustrated with research into a bond of the heavily indebted South Africa (graph 1).

Graph 1: Holders of the South Africa bond that expires in 2024

Non-IIF members holding more than 1% of the bond: Fuh Hwa Securities Investment Trust Co Ltd (47.5%), Schroder Investment Management (Taiwan) Limited (1.7%) and Prescient Investment Management Pty Ltd (1.0%); Affiliates of IIF members holding more than 1% of the bond: BlackRock subsidiaries (3%), TIAA Global Asset Management (2.1%), RBC Global Asset Management Inc (1.7%), Metropolitan Life Insurance Co (US) (1.4%). Source: Refinitiv (downloaded 26 March 2021) and SOMO research.

The IIF was called upon by the G20 because, for decades, it has sponsored various voluntary and market friendly instruments to deal with developing country debt. Through the “Principles for stable capital flow and fair debt restructuring”, the IIF promoted transparency, cooperation, good faith and fair treatment between borrowing governments and private creditors. Although the IIF runs the secretariat of the Principles’ Group of Trustees and Consultative Group, IIF members have no obligation to apply the Principles. The IIF’s comparative advantage comes from its membership and the many databases and briefings on debt. That information is mostly not accessible to the public and governments, which is at odds with the IIF’s own Voluntary Principles for Debt Transparency(opens in new window) .

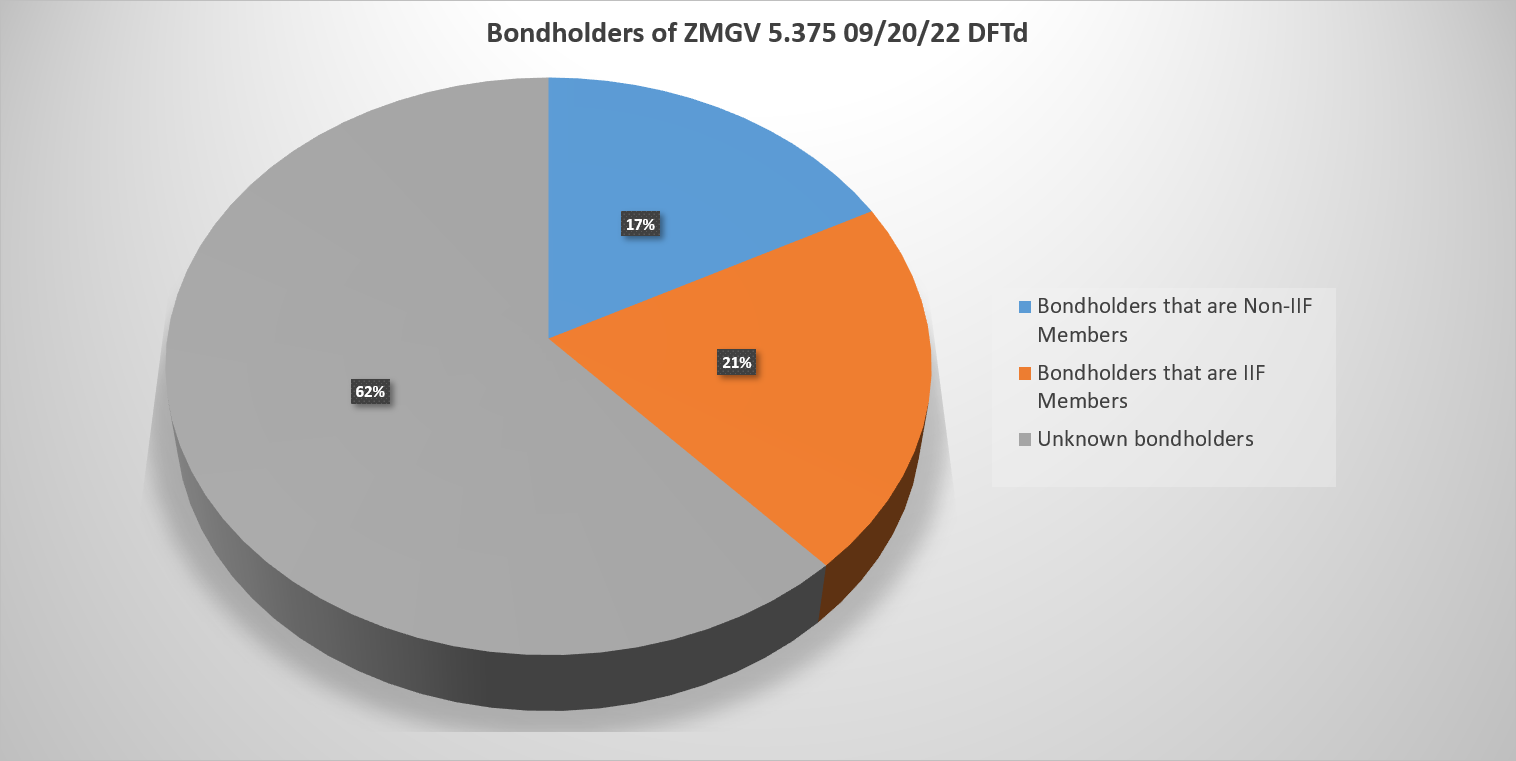

The IIF and its member committees specialised in public debt have been actively discussing the DSSI with the G20, the Paris Club, public creditors, non-IIF members and debtor countries. The IIF responded in May 2020 by designed its own “IIF Terms of Reference of Voluntary Private Sector Participation in the G20/Paris Club DSSI”. In July, the IIF issued a “Template Waiver Letter Agreement” to avoid that lower credit ratings were stopping countries’ participation in the DSSI. Nevertheless, these new IIF instruments seem not to have affected debt negotiations at national level, as for instance during Zambia’s crisis after it defaulted on its debt. An analysis of the Zambian bond that expires in 2022, reveals that some known bond holders were IIF members who could have promoted and used the IIF instruments.

Graph 2: Holders of a Zambia bond that expires in 2022

Affiliates of IIF members holding 1% or more of the bond, as known on 26 March 2021: Amundi subsidiaries (5.5%), UBS Asset Management (2%), PIMCO (1.3%), INVESCO Asset Management Limited (1.2%), JPMorgan Asset Management U.K. Limited (1%), Finisterre Capital LLP (1%). Source: Refinitiv (downloaded 26 March 2021) and SOMO research.

Affiliates of IIF members holding 1% or more of the bond, as known on 26 March 2021: Amundi subsidiaries (5.5%), UBS Asset Management (2%), PIMCO (1.3%), INVESCO Asset Management Limited (1.2%), JPMorgan Asset Management U.K. Limited (1%), Finisterre Capital LLP (1%). Source: Refinitiv (downloaded 26 March 2021) and SOMO research.

- The IIF interpreted its role to the G20 as being “the principal point of contact, knowledge partner and clearinghouse to generate private sector feedback and support.” That role is questionable given that many of its members had no interest in reducing debt payments at debtor country level and many bondholders are not members of the IIF.

- The voluntary G20 approach towards the private creditors and the IIF voluntary instruments did not result in much needed debt relief. All official proposals like those at the high level of the UN have failed to solve the problem of private creditors in order to avoid a major global debt crisis.

SOMO will continue to research how the IIF is influencing the proposals for solutions, especially at the G20 level.

Do you need more information?

-

Myriam Vander Stichele

Senior Researcher

Related content

-

Myriam Vander StichelePosted in category:Publication

Myriam Vander StichelePosted in category:Publication Myriam Vander Stichele

Myriam Vander Stichele

-

Debt crisis alert. End of Quantitative Easing poses grave risks for emerging economiesPosted in category:News

Debt crisis alert. End of Quantitative Easing poses grave risks for emerging economiesPosted in category:News Rodrigo FernandezPublished on:

Rodrigo FernandezPublished on: -

The politics of quantitative easing Published on:

Rodrigo FernandezPosted in category:Publication

Rodrigo FernandezPosted in category:Publication Rodrigo Fernandez

Rodrigo Fernandez

-

Growing investment in developing country bonds problematic for financial stabilityPosted in category:News

Growing investment in developing country bonds problematic for financial stabilityPosted in category:News Myriam Vander StichelePublished on:

Myriam Vander StichelePublished on: