EU health data law rolls out the red carpet for Big Tech

European Parliament should vote against the EHDS in its current form

The upcoming European Health Data Space (EHDS) opens the door to an unprecedented expansion of Big Tech into the health sector. In its current form, the EHDS exposes EU citizens’ private health data to Big Tech and pharmaceutical companies, allowing these companies to further strengthen their monopolistic market power. In the past years, Amazon, Apple, Google, and Microsoft concluded over 200 partnerships with healthcare and pharmaceutical companies around the world. The total value of investment deals in the health sector involving Big Tech exceeded EUR 35 billion (between 2012 and 2023).

Amazon, Apple, Alphabet (Google) and Microsoft are in a perfect position to extend their reach into the health sector. Their infrastructural, intellectual property, data, financial, and political power, enables them to exercise monopoly power. While new digital health technologies and systems can provide substantial benefits to patients and healthcare professionals, the monopolistic market power of Big Tech companies poses real and severe risks to the well-being of patients, the rights of citizens and the proper functioning of healthcare systems.

The monopoly power of Big Tech will enable tech companies to set rules and standards in the health sector, e.g. related to the digital health infrastructure, such as cloud storage for health data, electronic health record systems, and other technologies. It will also give them the ability to charge excessive prices for the products and services they develop. Ultimately, healthcare users and taxpayers will end up paying the price of Big Tech’s monopoly power, while also being confronted with significant risks of harmful effects on patient well-being and on the democratic governance of healthcare systems.

Rolling out the red carpet for Big Tech

The EU proposal for setting up the European Health Data Space (EHDS) provides Big Tech companies with a key opportunity to expand their presence and power over the European health sector. This new law will oblige healthcare providers across the EU to collect and process patient health data in digital patient records, including medical information, lab results, and medical images, in a standardised and exchangeable format. These data can then be used by healthcare providers to exchange information for the provision of primary care to patients. The EHDS will also make these data available for secondary purposes, such as scientific research, policy-making, and the development of products and services by companies.

The EHDS will create a strong dependency on Big Tech companies for the provision of critical digital health infrastructure. It will also provide Big Tech companies with unprecedented opportunities to benefit from EU citizens’ health data for the development of their products and services, fuelling their profits and market power. As such, the EHDS stands in stark contrast to the EU’s efforts to contain Big Tech monopoly power through e.g. the Digital Markets Act (DMA) and the Digital Services Act (DSA), as well as recent interventions by market regulators.

Only a week after a provisional political agreement(opens in new window) with the European Parliament negotiators was reached, EU Member States adopted(opens in new window) the EHDS in March 2024. The European Parliament still has a final opportunity to prevent rolling out the red carpet for Big Tech in EU healthcare systems when it votes on the compromise text on 24 April 2024.

Big Tech monopoly power in the health sector

The EHDS facilitates the growth of Big Tech’s power in the health sector in at least two ways. First, the EHDS creates a huge demand for digital infrastructural services, such as cloud space for storing and processing health data and digital health record systems, for which Big Tech is in the best position to be providing these services. Second, Big Tech companies, with their leading capabilities in Artificial Intelligence (AI) and dominant position in the market for cloud storage, are set to be among the largest beneficiaries of the swathes of health data that will become available for secondary use.

The final agreement between EU Member States and the European Parliament, which was reached in March 2024 after intense negotiations, fails to sufficiently address these issues. While it contains provisions on interoperability of health record systems (which should make it easier for healthcare providers to switch between different providers of digital infrastructure), this alone is not enough to curb the strong infrastructural power Big Tech currently has. It also lacks binding provisions that ensure EU citizens and societies benefit from the products and technologies that will be developed with the use of their health data, instead of being faced with patented technologies that only become available at a high cost.[1]

No real ‘opt-out’ from the re-use of health data

The political compromise on the possibility for citizens to ‘opt-out’ from their health data being made available for secondary use by no means gives EU citizens strong guarantees that their health data will not be re-used without their permission. The EHDS makes it possible for governments to override a decision to opt out if they wish to use the health data for a very loosely defined range of purposes, including statistics, policy-making, and ‘the public interest’.[2]

It remains possible that governments will rely on third parties, including Big Tech companies, to process and analyse these data. Governments may also face pressure from e.g. Big Tech, insurance, and pharmaceutical companies to make more health data available for secondary use. The EHDS thus contains anything but a true ‘opt-out’ from the secondary use of EU citizens’ health data.

A EUR 1.6 trillion healthcare market

The European healthcare sector forms a large source of potential revenue for Big Tech companies. Overall expenditure on healthcare in the EU amounted to EUR 1.4 trillion (9.9 per cent of the EU GDP) in 2019, growing to EUR 1.6 trillion (10.9 per cent of the EU GDP) in 2021, when the Covid-19 pandemic was in full swing.[3]

Market analysts expect the EU market for digital health products and services, such as telemedicine, and electronic health record systems, to double or even triple in size between 2023 and 2030, with some analysts projecting a market size of up to USD 159 billion in 2028.[4] Even if Big Tech companies are only able to capture a small portion of that expenditure on healthcare and digital health, this could still substantially boost their revenues and profits.

Moreover, EU healthcare staff and healthcare providers form a very large potential client base and source of data for Big Tech companies, e.g. for the development and sale of digital health products and services. There are an estimated 1.8 million physicians, 3.9 million practising nurses, and 3.7 million practising caring personnel, such as healthcare assistants and home-based personal care workers, working in the EU.[5]

Big Tech’s expansion into the health sector

Over the past years, Amazon, Apple, Alphabet and Microsoft have been eager to expand into virtually every subsector of the healthcare domain, including cloud storage services for health data, digital health infrastructures and electronic health records, and the development of AI technologies in healthcare. Big Tech has expanded into the health sector, particularly in the United States, by employing four different strategies:

- the development of in-house products and services;

- investments in and acquisitions of companies in the health sector, including start-ups;

- forging partnerships, e.g. with healthcare providers and research institutes;

- registering patents.

Development of in-house products and services – Over the past ten years, the four Big Tech companies have all been investing in their capabilities and activities in the healthcare domain. These products and services include, among others, the provision of cloud services for healthcare, the development of electronic health records and medical data systems, research into health-related Artificial Intelligence (AI), and the development of health and wellness applications and devices. Some of the Big Tech companies have also been developing activities related to primary care services, pharmacy services, or the development of medicine.

Amazon, Google and Microsoft have developed extensive cloud data storage and processing environments for the healthcare sector, such as Amazon Web Services for Healthcare & Life Sciences(opens in new window) , Google Cloud for Healthcare and Life Sciences(opens in new window) and Microsoft Cloud for Healthcare. In addition to providing storage space for medical data, these cloud platforms also offer a wide range of other services, including medical imaging processing using AI, medical and genomic data analysis, and medical speech-to-text conversion.

Other notable products and services, among many others, include the development of health data-focused apps, such as the Apple Health app and Google Fit and Health Connect, which enables the collection and sharing of health data between different health and wellness apps and with healthcare providers. Amazon launched its digital pharmacy service in the United States in 2020 (Amazon Pharmacy(opens in new window) ) and set up Amazon Clinic(opens in new window) in 2022, through which it provides virtual healthcare services in the US.

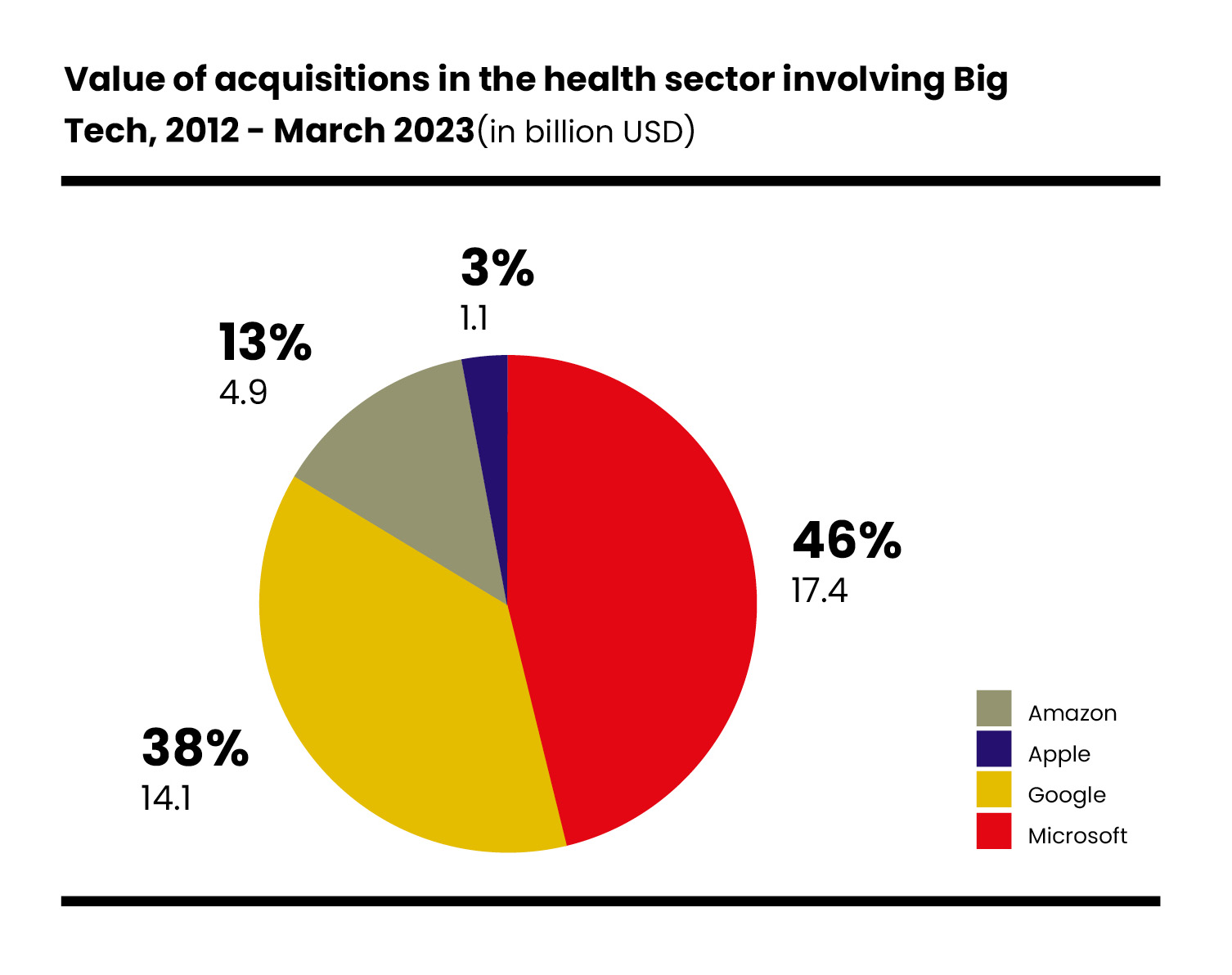

Investments and acquisitions – Investor data show that, between 2012 and March 2023, Amazon, Apple, Alphabet, and Microsoft were part of investment deals involving at least 114 companies in the health sector, with a total value of at least EUR 35.3 billion (USD 37.6 billion). These investments were mostly conducted through investor groups consisting of investment firms, venture capital funds, and asset management companies, and mainly comprised the acquisition of minority stakes in other companies.

Not all investments, especially smaller venture capital investments in start-up companies, are reported publicly, which means these figures likely underestimate the total number and value of Big Tech’s expenditure on buying up other companies in the health sector. Google alone, for example, has invested in over 143 companies in the healthcare sector since 2009 through its venture capital subsidiary GV.[6]

Notable high-value acquisitions in the past years include Google’s purchase of wearable device manufacturer Fitbit in 2019 (USD 2.1 billion), Microsoft’s acquisition of AI conversational technology company Nuance Communications in 2021 (USD 16.3 billion), and Amazon’s acquisition of primary healthcare clinic chain 1Life Healthcare (One Medical) in 2023 (USD 3.7 billion), among others.

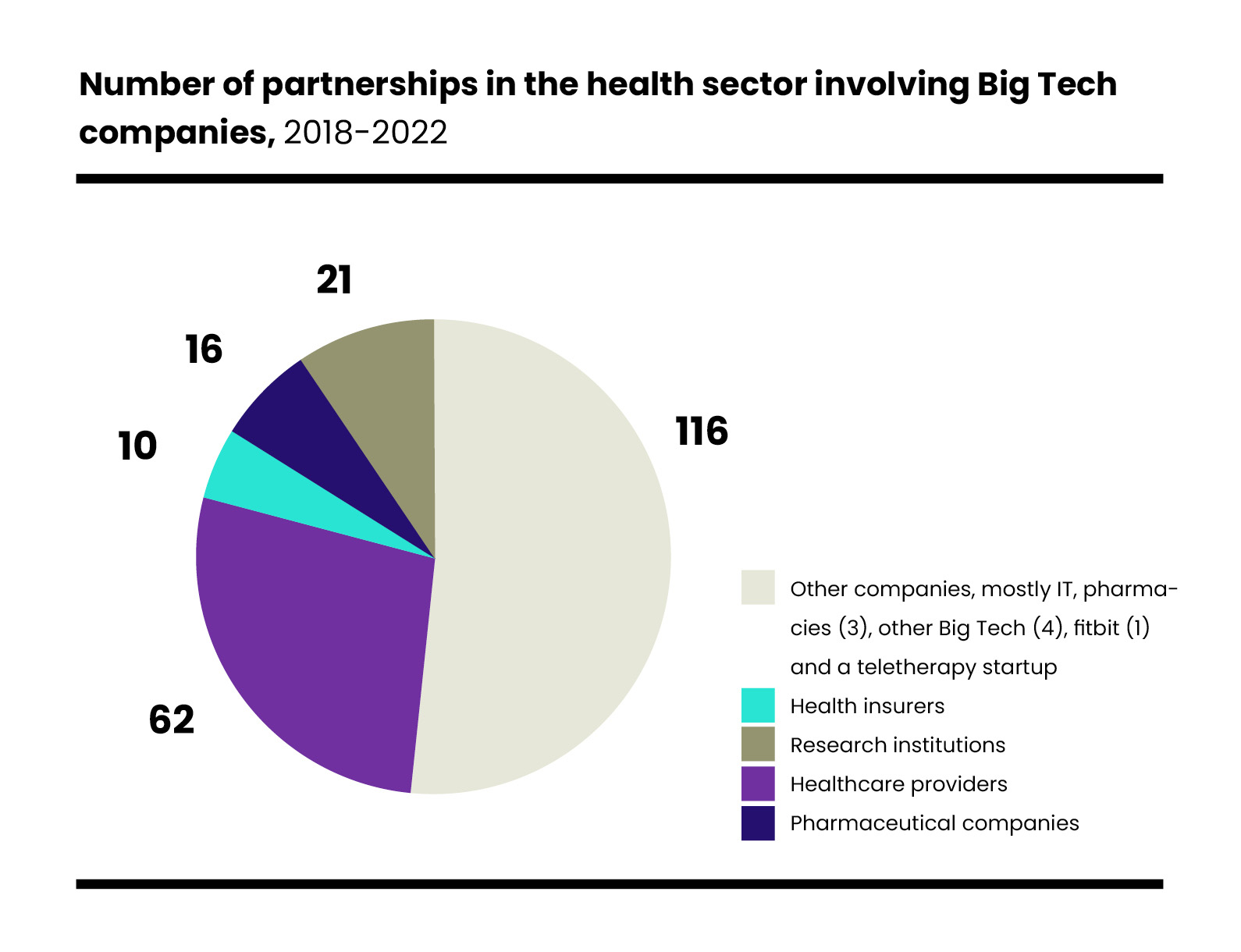

Partnerships – Between 2018 and 2022, Amazon, Apple, Alphabet, and Microsoft entered into at least 225 partnerships with research institutes, healthcare providers, IT companies, pharmaceutical companies, health insurers, and other entities active in the healthcare sector, mainly in the United States. Almost half of these partnerships involved Alphabet (Google), followed by Microsoft (23 per cent).

These partnerships have given Big Tech companies access to vast amounts of health data, including patients’ medical records and medical images, which helps them to further develop their products and services, including through AI data processing and analytics. The partnerships often include agreements on large-scale, long-term data transfers from healthcare providers to Big Tech companies. A controversial example is Google’s Project Nightingale(opens in new window) , which involved the transfer of the entire medical records of over 50 million US patients from healthcare provider Ascension to Google without their consent in 2018 and 2019.

Patent filings

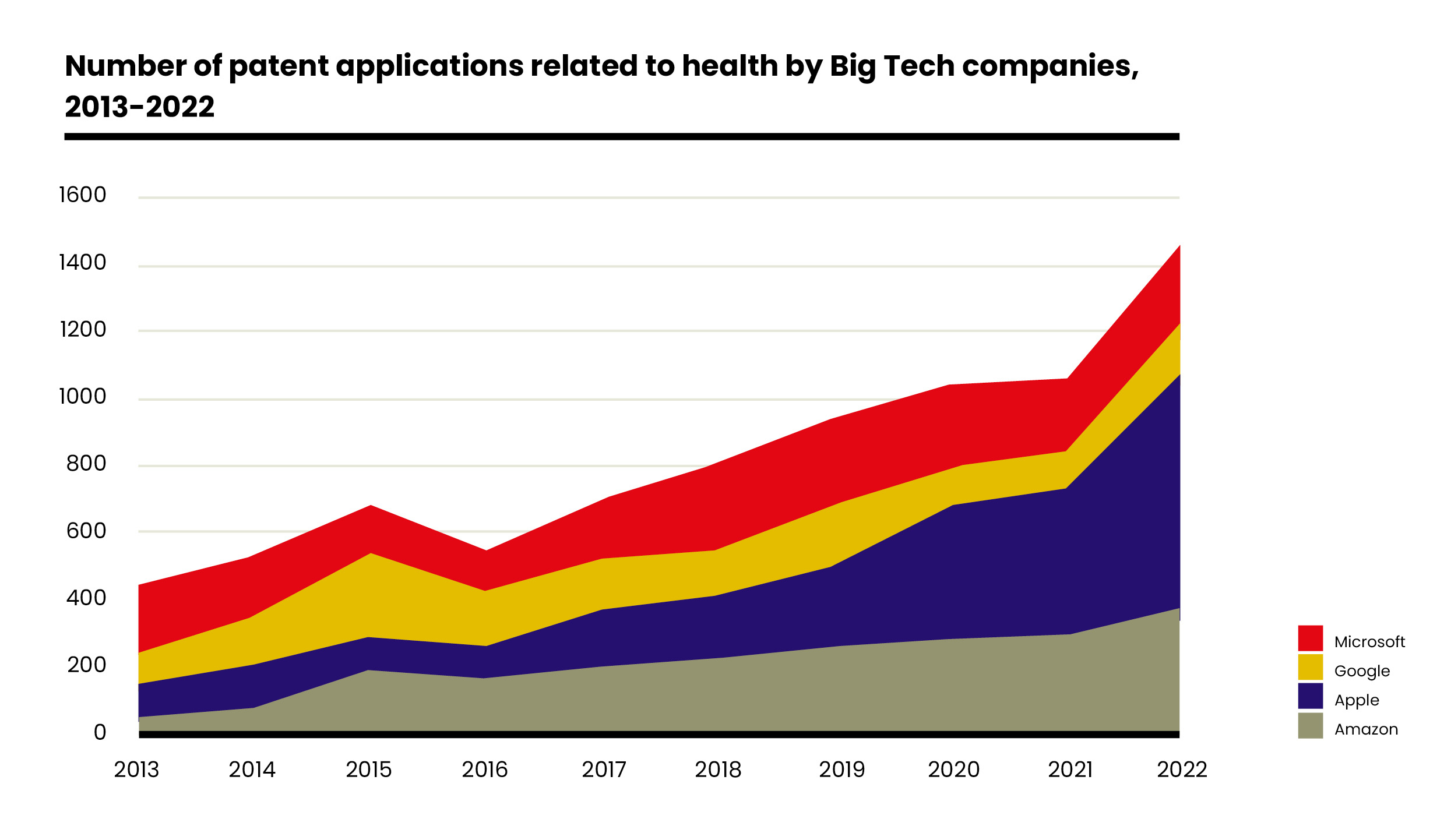

Between 2013 and 2022, the number of annual health-related patent applications the four Big Tech companies filed with the United States Patent and Trademark Office (USPTO) increased more than threefold, from 437 in 2013 to 1456 in 2022. The number of health-related patent applications by Apple, in particular, grew strongly in this period, from less than 100 in 2013 to over 700 in 2022 (a 650 per cent increase).[7] Health-related patent filings by Amazon grew relatively even more strongly (667 per cent), while the number of filings from Microsoft remained relatively stable.

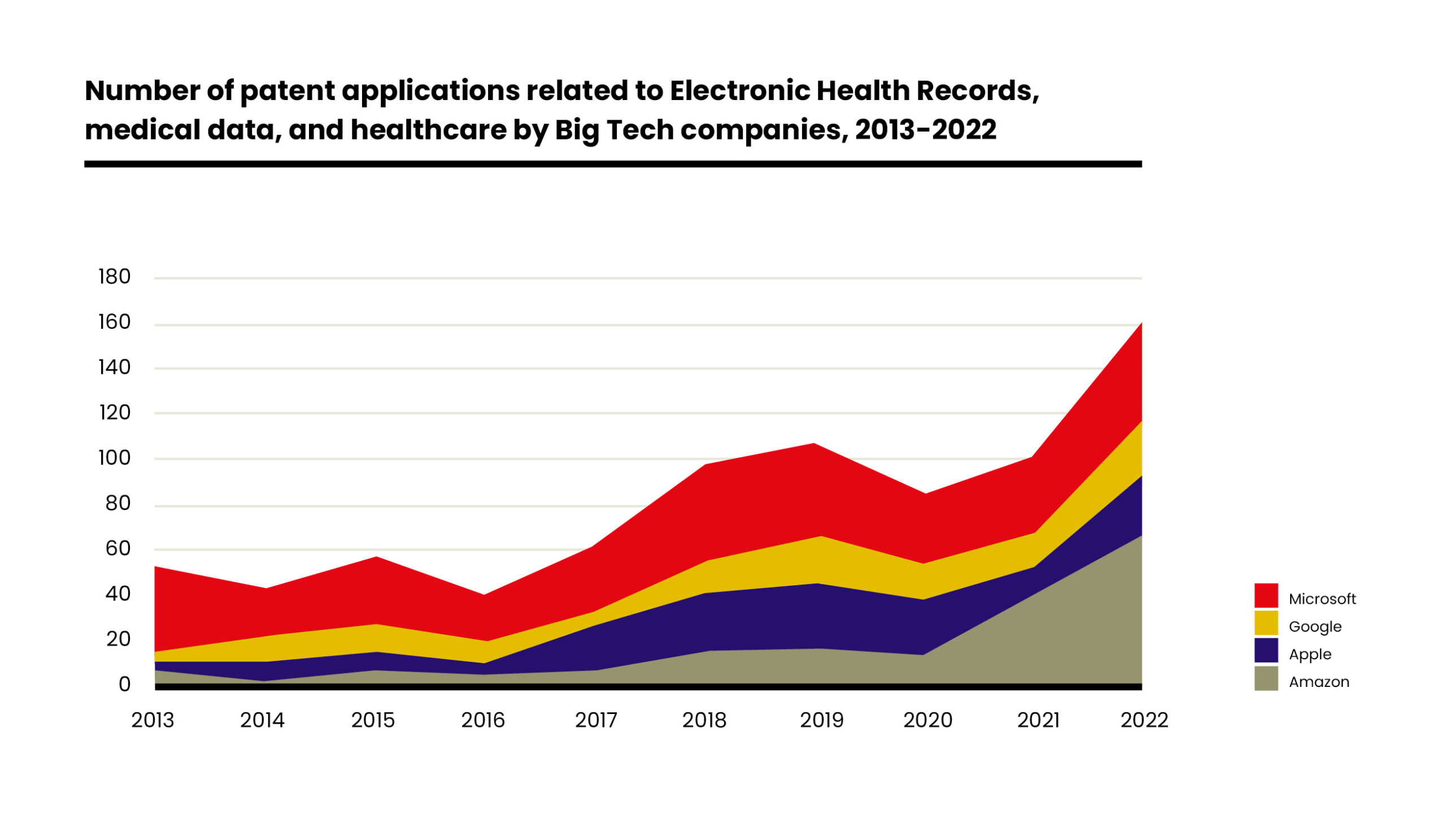

The number of health-related patent applications that specifically refer to electronic health records (EHR), medical or patient data or healthcare is also on the rise. Between 2013 and 2002, the four tech companies filed over 800 patent applications in these fields, with annual applications averaging 50 between 2013 and 2015 and growing to over 110 on average between 2020 and 2022. Microsoft filed the largest number of applications (329), followed by Amazon (170) and Apple (167).

Research has shown(opens in new window) that patent applications resulting from partnerships between Big Tech companies and academic research institutes and/or healthcare providers are submitted by these Big Tech companies alone in over 99 per cent of the researched publications. In this way, Big Tech companies can get exclusive ownership of patents that were developed in cooperation with other (public) entities.

European Parliament needs to fix the EHDS

Big Tech’s current expansion in the health sector may only be the beginning of what is yet to come if the EHDS is adopted. EU rules for health data must defend the interests of EU patients, instead of the private profits and power of Big Tech. SOMO therefore calls upon the European Parliament to vote against the EHDS in its current form and to return to the negotiation table. Lawmakers can fix the EHDS by including clear provisions on societal benefits of health data sharing and fair prices of products and services developed with these data. They should also ensure citizens have a firm say in decisions on health data sharing and invest in public digital health infrastructure rather than relying on tech companies. The EHDS should also provide EU citizens with real control over their medical data by including an unambiguous possibility to opt out from health data sharing.

About this article

The figures and numbers in this article are based on data from Refinitiv Eikon, the US Patent and Trademark Office, and an analysis of news articles in LexisNexis. SOMO provided Amazon, Alphabet (Google), Apple, and Microsoft with an opportunity to review the data before publication and asked these companies questions about their position regarding the EHDS. Apple and Alphabet did not respond to this request, while Microsoft declined to comment. Amazon provided a comment on the data but did not respond to the questions.

NOTES

[1] While Recital 41 mentions that “the secondary use of health data for research and development purposes should contribute to a benefit to society in the form of new medicines, medical devices, health care products and services at affordable and fair prices for Union citizens, as well as to enhancing access to and the availability of such products and services in all Member States”, the EHDS lacks binding provisions that ensure this will be the case.

[2] Art. 35F and 34.1 of the final compromise.

[3] ‘Health Care Expenditure by Financing Scheme(opens in new window) ’, accessed 22 November 2023.

[4] Market Data Forecast Ltd, ‘Europe Digital Health Market Worth USD 95.00 Bn By 2028(opens in new window) ’, Market Data Forecast, accessed 22 November 2023; ‘Europe Digital Health Market Size And Share Report(opens in new window) , 2030’, accessed 22 November 2023; ‘Europe Digital Health Market – Share, Size & Industry Analysis(opens in new window) ’, accessed 22 November 2023.

[5] ‘Healthcare Personnel Statistics – Physicians(opens in new window) ’, accessed 22 November 2023; ‘Healthcare Personnel Statistics – Nursing and Caring Professionals(opens in new window) ’, accessed 22 November 2023.

[6] Synchronized, ‘GV – Portfolio(opens in new window) ’, accessed 23 May 2023.

[7] It must be noted that part of the increase in patent applications that refer to ‘health’ by Apple can be explained by the company’s regular use in patent applications of a number of identical phrases in which the word ‘health’, even when that specific application otherwise does not appear to directly involve health-related technologies (e.g. a reference to the Health Insurance Portability and Accountability Act – HIPAA).

Do you need more information?

-

Irene Schipper

Senior Researcher -

David Ollivier de Leth

Researcher

Related news

-

-

Digital Markets Act: Big Tech’s pushback faces up to a bold EUPosted in category:Long read

Digital Markets Act: Big Tech’s pushback faces up to a bold EUPosted in category:Long read Margarida SilvaPublished on:

Margarida SilvaPublished on: -