The hidden human costs linked to global supply chains in China

2024 labour violations in China linked to global supply chains

Similar to 2023, many workers in China’s apparel and electronics sectors have faced unpaid wages for months of work in 2024, often coinciding with job losses for which they are also owed severance. Research by SOMO and China Labour Bulletin (CLB) links over 80 international brands to these labour rights abuses and reveals the human cost behind shifting supply chains in the apparel and electronics industries.

Capturing worker voices

The complexity and lack of transparency in global supply chains involving China, coupled with restrictions on Chinese civil society, mean that direct access to information about labour rights issues in the country’s export sectors is limited. However, Chinese workers frequently use social media and other online platforms to voice grievances and document their experiences with employers. CLB captures this information and publishes it on its Strike Map(opens in new window) , creating the most comprehensive and systematic public record of worker protests and strikes in China.

Over the past year, SOMO has continued using this resource to uncover connections between factories where abuses are reported and international brands sourcing from them. By identifying factory names, gathering operational details, and tracing trade links, SOMO is able to shed light on the role of global supply chains in labour rights violations in China.

Key trends and findings from 2024

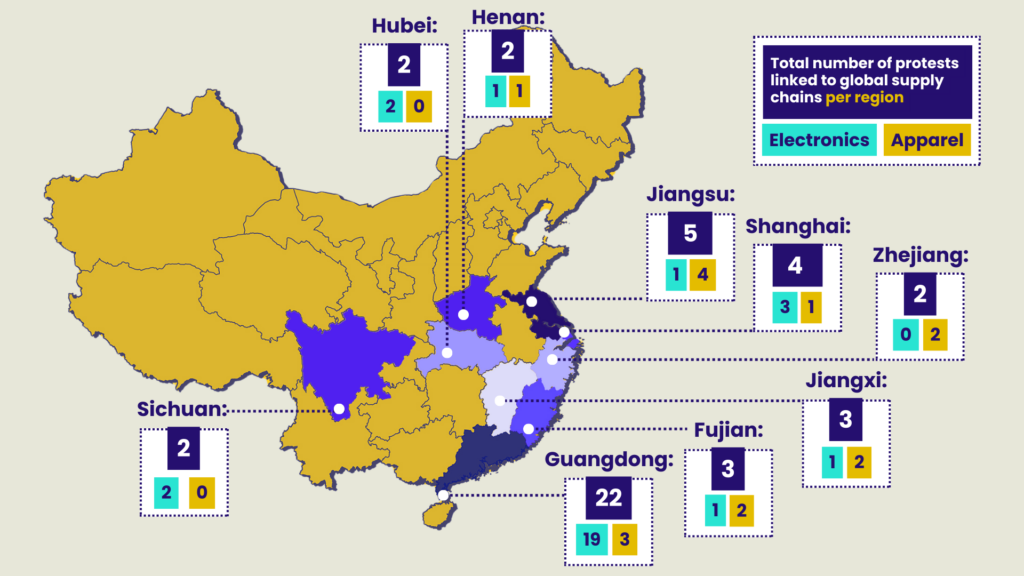

So far, in 2024, 174 incidents have been recorded on CLB’s Strike Map in the apparel and electronics sectors.

SOMO researched 136 of these cases:

- 84 in the electronics sector (62%)

- 52 in the apparel sector (38%)

Links to global supply chains

SOMO’s corporate and supply chain research identified potential links between 45 of the 136 incidents (33%) and global brands:

- 33 incidents in the electronics sector

- 12 incidents in the apparel sector

SOMO linked labour protests to supply chains of major multinational brands

Reasons for protests

Among the protests linked to global supply chains:

- 37.8% were over wage arrears.

- 31.1% stemmed from disputes related to factory closures or relocations.

Many Chinese factories operate on very thin economic margins. Reduced orders or the loss of major customers often lead to wage delays, leaving workers unpaid for weeks or months. Layoffs caused by closures exacerbate these challenges.

Sector-specific challenges

Electronics sector

Notably, 57.6% of the incidents linked to electronics supply chains occurred in Guangdong province, especially the Pearl River Delta region adjacent to Hong Kong, a long-standing hub for export-driven electronics manufacturing where many factories are recently closing or relocating to other parts of China or Asia. Labour disputes in the electronics sector frequently involved producers of printed circuit boards for consumer electronics, automotive, and other industries.

Apparel sector

The apparel sector has been particularly hit hard by China’s economic slowdown and reduced domestic demand. Fewer incidents in the apparel sector could be linked to global brands, most likely because many smaller factories appear to operate in local supply chains, catering to China’s e-commerce market. While these factories may not supply global brands, their struggles signal broader vulnerabilities for workers in the sector.

The human cost and future risks

As outlined in our report Chain of Consequences covering 2023 trends on worker protests in the manufacturing sector in China, geopolitical shifts and other factors have driven buyers to source components from Southeast Asia, leaving Chinese workers struggling to get paid the wages and compensation they are owed when production relocates or factories close.

Anticipated increases in US tariffs on Chinese imports under the new Trump administration are expected to prompt more and more companies to reduce the sourcing of Chinese goods. Many brands have been preparing for what could be a dramatic restructuring of global manufacturing and trade that will have far-reaching and unpredictable effects.

But how prepared are brands to ensure that ending supplier relationships is done responsibly and that workers are not left with unpaid wages and benefits when factories close? The effort and attention that goes into managing and minimising negative impacts on business should be matched by the consideration given to the human cost of significant changes to supply chains, particularly when the impacts are likely to be cumulative.

More than ever, brands must implement policies to exit supplier relationships responsibly and uphold their responsibility to respect human rights across their operations and supply chains.

Use our visual guide to learn how SOMO tracks global supply chains!

This visual guide is a tool for civil society organisations and journalists investigating labour abuses in Chinese factories. It supports efforts to hold multinational corporations accountable for unfair business practices in their supply chains.

Do you need more information?

-

Joshua Rosenzweig

Senior Advisor on Business and Human Rights & China -

Virginia Sandjojo

Senior Policy and Advocacy Officer

Related news

-

Major brands sourcing from China lack public policies on responsible exitPosted in category:News

Major brands sourcing from China lack public policies on responsible exitPosted in category:News Joshua RosenzweigPublished on:

Joshua RosenzweigPublished on: -

Linking labour issues in China to global brands Published on:Posted in category:Publication

-

Chain of consequences Published on:

Joshua RosenzweigPosted in category:Publication

Joshua RosenzweigPosted in category:Publication Joshua Rosenzweig

Joshua Rosenzweig