Green Bond standards?

In order to make ‘green bonds’ more credible and transparent when they are issued by governments or companies, the European Commission wants to introduce an EU standard with better definitions and processes. This should ensure that the money invested in the bond will achieve environmental objectives. A technical expert group has advised that such an EU standard should not be compulsory for all green bonds, should not be set by law and should not be sanctionable if environmental impact claims are not met. It remains up to the new Commission whether to follow this advice.

Voluntary?

Green bonds have become a popular and growing instrument(opens in new window) to invest in climate or environmentally-friendly activities by governments or companies. However, the various market initiatives are not always clear on the extent to which the investment benefits the environment or climate. The European Commission (EC) has asked the Technical Expert Group on Sustainable Finance (TEG)(opens in new window) for advice on how to create a standard for green bonds.

In short(opens in new window) , the final advisory report of the TEG in June 2019 proposes that the EC creates an EU Green Bond Standard that is voluntary and non-legislative, i.e. not all green bonds are obliged to adhere to the EU standard, nor is the EU standard set by law. A green bond that applies the EU standard can be issued by an issuer (government, company, other) in the EU or elsewhere, and sold either on an exchange or elsewhere.

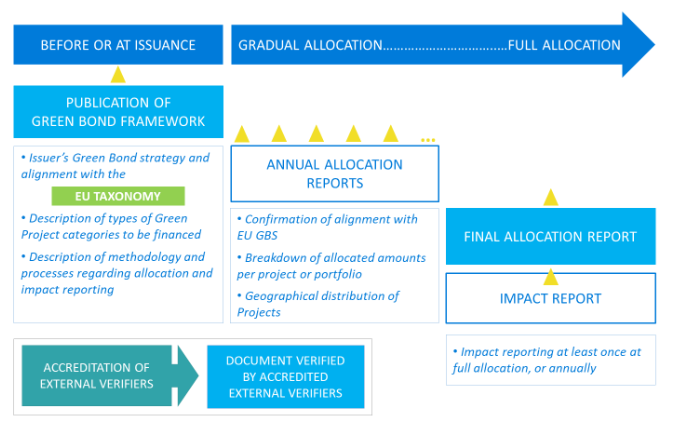

When issuers implement the EU Green Bond Standard (EU GBS), they must:

- Finance or re-finance activities defined by the EU taxonomy and apply the taxonomy’s do-no-harm screening criteria;

- Publish upfront a Green Bond Framework that explains all key aspects of the proposed use of funds paid by the bond holders, the processes and reporting, and how the issuer’s strategy aligns with environmental objectives;

- Regularly report on 1) how the money is allocated, and 2) the environmental impact

- Require an external verifier to review the Green Bond Framework and the final report on the financial allocation.

The TEG also recommends that external verifiers are officially accredited and supervised by the European Securities and Markets Authority (ESMA). During transition years, accreditation could be carried out by an interim registration process. External verifiers are now a kind of unregulated sustainability credit rating agencies, e.g. Sustainalitics(opens in new window) .

Table: Processes to be applied when issuing in accordance with the EU Green Bond Standard (GBS)

Source: EU Technical Expert Group on Sustainable Finance, Report on the EU Green Bond Standard(opens in new window)

Comments

If the EC were to follow the TEG’s and financial lobby’s advice on the voluntary nature of the EU Green Bond Standard, it would be a missed opportunity to prevent false climate and environmental claims, as not all green bonds will be forced to apply the standard. NGOs have advised(opens in new window) that the standard be compulsory. The voluntary nature of this popular green investment instrument contrasts with the urgency of re-orienting capital towards effective positive climate and environmental impact. The question remains in how far issuers and investors will be willing to adhere to the EU Green Bond Standard, as the requirements will make bonds not only more transparent and credible, but also more expensive to issue and report on.

The fact that the environmental impact report will not be verified by external reviewers raises doubt as to what can be done to enforce real positive environmental impact, as well as sanctions in the event that the proposed environmental impact has not been reached.

It is important for external verifiers to be accredited and supervised, and also regulated, since the current verifications of green bonds are not based on specific legal requirements and the so-called sustainable credit bureaus are not supervised.

Do you need more information?

-

Myriam Vander Stichele

Senior Researcher

Related news

-

Why share buybacks are bad for the planet and peoplePosted in category:Opinion

Myriam Vander StichelePublished on:

Myriam Vander StichelePublished on: Myriam Vander Stichele

Myriam Vander Stichele -

The trillion-dollar threat of climate change profiteersPosted in category:Long read

The trillion-dollar threat of climate change profiteersPosted in category:Long read Myriam Vander StichelePublished on:

Myriam Vander StichelePublished on: -

The treaty trap: The miners Published on:

Vincent KiezebrinkPosted in category:Publication

Vincent KiezebrinkPosted in category:Publication Vincent Kiezebrink

Vincent Kiezebrink