Dutch banks spend millions on lobbying

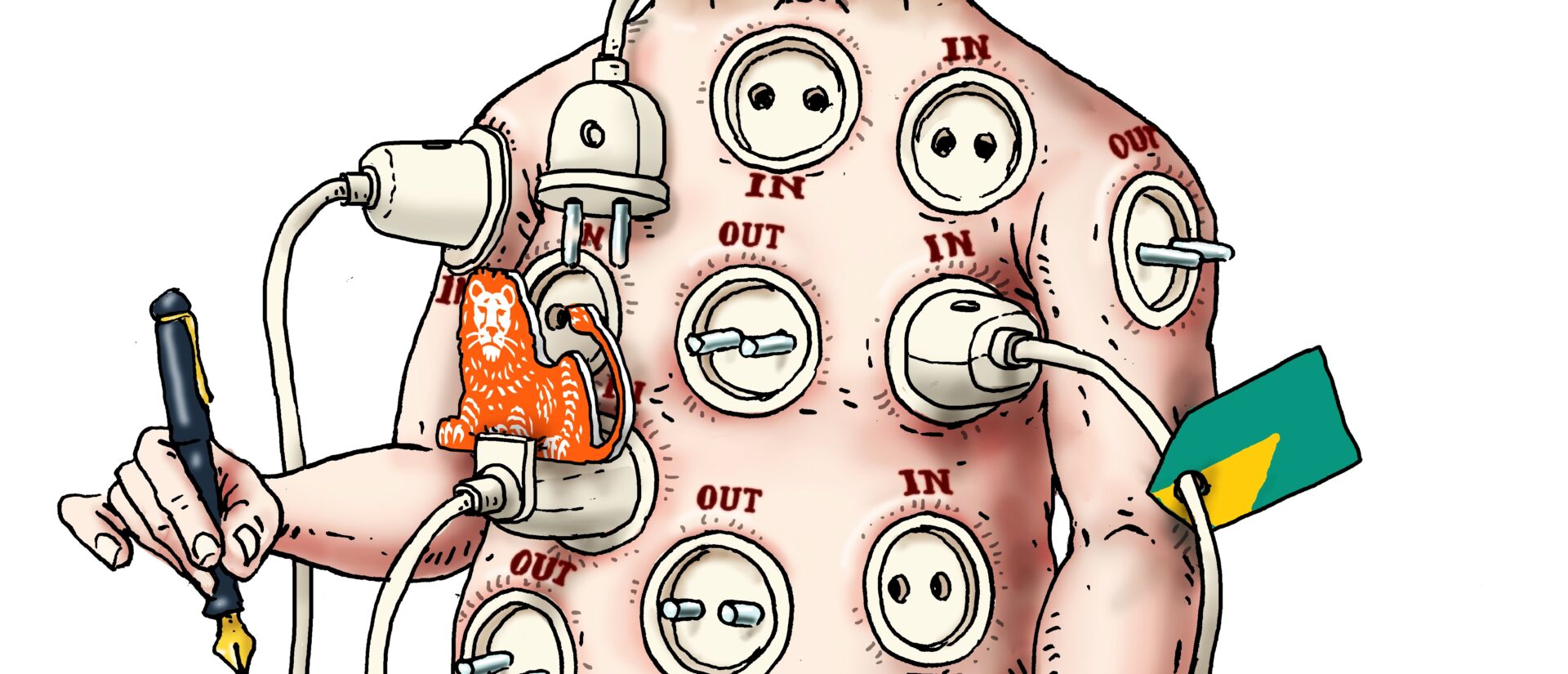

Dutch banks spend millions on lobby through their own channels, through interest groups like the Association of Dutch Banks (VNB) and through lobby organisations in the Netherlands, the EU and worldwide. At the same time, it is often unclear how lobbying is organised exactly and banks are not transparent about their activities, concludes SOMO’s latest report A structural problem in the shadows – Lobbying by banks in the Netherlands.

A Structural problem in the shadows

Powerful lobby

“The powerful lobby by Dutch banks is not very visible in the Netherlands and in the EU, where most financial laws are made. Banks have a very strong influence, at the expense of public interests”, says researcher Myriam Vander Stichele. “For ordinary citizens, it is close to impossible to find out how to influence the legislative process regarding financial laws.”

The SOMO study describes in detail how lobby is organised within the six Dutch banks, and how transparent they are about their lobby activities. The major banks ING, ABN AMRO and Rabobank are better at making their voices heard at the Ministry of Finance than the smaller banks, Triodos Bank, SNS Bank and ASN Bank.

Example: ING Bank

“ING has the biggest lobby capacity, with an in-house lobby unit of 17 employees. Furthermore, the bank is a member of 38 financial lobby organisations, and spends at least € 400,000 on representation in Brussels with European institutions. They also spent approximately three million euros on their NVB membership”, says Vander Stichele. “This unbalanced and opaque lobby risks drowning out public voices, a situation which is regarded as one of the causes of the financial crisis in 2008.”

Last Thursday, the Dutch government responded to Lobby in Daylight(opens in new window) by Labour MPs Lea Bouwmeester and Astrid Oosenbrug. Minister Plasterk’s (of the Interior and Kingdom Relations) respons is very meagre and vague. Myriam Vander Stichele: “Lobby by large banks is a social and structural problem. We think that binding measures are needed to increase transparency, and to ensure that different voices are heard in new legislation.”

Do you need more information?

-

Myriam Vander Stichele

Senior Researcher

Related content

-

SOMO shifts Dutch banks towards more transparency on their lobbying activitiesPosted in category:NewsPublished on:

SOMO shifts Dutch banks towards more transparency on their lobbying activitiesPosted in category:NewsPublished on: -

A Structural problem in the shadows Published on:

Myriam Vander StichelePosted in category:Publication

Myriam Vander StichelePosted in category:Publication Myriam Vander Stichele

Myriam Vander Stichele

-

Why share buybacks are bad for the planet and peoplePosted in category:Opinion

Myriam Vander StichelePublished on:

Myriam Vander StichelePublished on: Myriam Vander Stichele

Myriam Vander Stichele