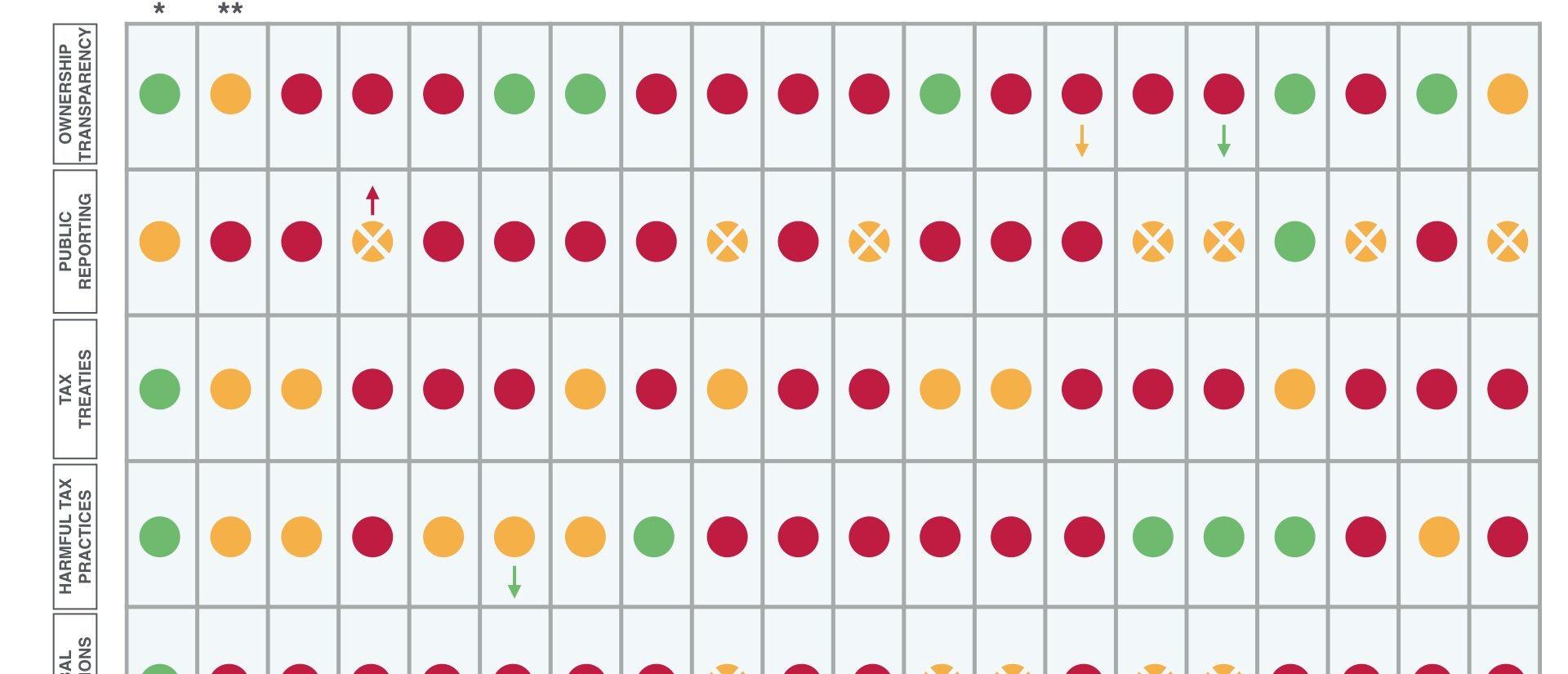

Europe leads the race towards a 0% corporate tax rate

Governments in Europa are slashing corporate tax rate in a very costly and destructive race to the bottom, conclude researchers in the latest Eurodad report Tax games: the race to the bottom. Europe’s role in supporting an unjust global tax system. Looking at the EU countries and Norway, 2 governments that have either just cut the corporate tax rate, or are planning to do so in the near future. The report shows that European governments are leading a trend which will see average global corporate tax rates hit 0% by 2052.

Tax games: the race to the bottom

As big businesses are made to pay less corporate tax, consumers have to pay more in order to fill the gap. This disproportionately hits the poorest and risks exacerbating inequality rather than reducing it. Furthermore, the report shows that half the countries analysed have harmful tax practices, which can be used by multinational corporations to avoid taxation. In addition, the research shows that of the 18 countries analysed, 12 have a ‘highly problematic’ tax treaties, which can undermine tax collection in developing countries.

Transparency is coming, but it’s an uphill climb. A third of the countries analysed are leading the fight against secret shell companies by introducing public company registers which show the real – beneficial – owners. However, secret company ownership is still possible in 12 of the analysed countries, and the UK still offers opportunities for setting up anonymous trusts.

“Despite all the tax scandals we’ve seen, a large group of European countries remain opposed to transparency. While we’re happy to see a progressive group of EU countries pushing ahead in the fight to end secret shell companies, they only make up a third of the countries we’ve looked at. If we want to see real change, we’re going to need more than that”, concludes Tove Maria Ryding, Eurodad’s tax coordinator.

Eurodad (opens in new window) has been publishing its annual state of the art report on tax in European countries since 2013. The chapter on the Netherlands has been written by Tax Justice Nederland(opens in new window) and SOMO.

Do you need more information?

-

Jasper van Teeffelen

Researcher

Partners

Related content

-

Tax games: the race to the bottom Published on:

Jasper van TeeffelenPosted in category:Publication

Jasper van TeeffelenPosted in category:Publication Jasper van Teeffelen

Jasper van Teeffelen

-

Survival of the Richest Published on:

Jasper van TeeffelenPosted in category:Publication

Jasper van TeeffelenPosted in category:Publication Jasper van Teeffelen

Jasper van Teeffelen

-

Giving with one hand and taking with the other – CSOs urge European leaders to take further action against tax dodgingPosted in category:NewsPublished on:

Giving with one hand and taking with the other – CSOs urge European leaders to take further action against tax dodgingPosted in category:NewsPublished on: -

Fifty shades of tax dodging Published on:

Indra RömgensPosted in category:Publication

Indra RömgensPosted in category:Publication Indra Römgens

Indra Römgens

-