Extraordinary measures can make finance work for society

Now that the financial markets are in turmoil, authorities are providing ever stronger measures and extra capital(opens in new window) . But the current panic in the financial markets is very much of their own making. For years, the financial industry has succeeded in fiercely opposing intervention and regulation that would have prevented the current financial distress. Authorities now have to face the resulting weak regulatory framework and restrict the viral excesses of the financial industry’s behaviour. Rather than fleeing and waiting on the sidelines, the financial players should invest in companies and measures that fight against the economic fallout of COVID-19.

The frenzied reaction of the financial markets to the corona virus – first ignoring, then fleeing – is a logical consequence of the rules of the game. Regulations still allow very short term buying and selling by all kind of speculative traders – high frequency traders, short sellers, automated computerized trading with algorithms, day traders and fund investors. Their immediate selling and buying is facilitated by broker-dealers, stock exchanges, investment bankers and ‘market makers’. Now, in times of market volatility, some are making huge profits.

Reinvest profits

The weak regulatory regime, loose monetary policy and low interest rates, together with extreme freedom of capital movements, have allowed many in the investment industry to make huge profits over the last years. These profits could now be reinvested and put to work. The five large US investment banks made $ 118 billion in profits in 2018. The investment fund industry made huge profits, e.g. BlackRock(opens in new window) made an annual net profit of $ 4.48 billion by managing $ 7 trillion by the end of 2019. Flow Traders(opens in new window) , a Dutch high frequency trader and market maker, made a profit of € 53.1 million in 2019, down from € 160.9 million in 2018.

These profits came from taking ever higher risks in search of high yields. What are the risks in the financial system which will aggravate successive supply shock, demand shock, financial shock, oil shock, health shock and economic shock?

Risks and profits come at a price

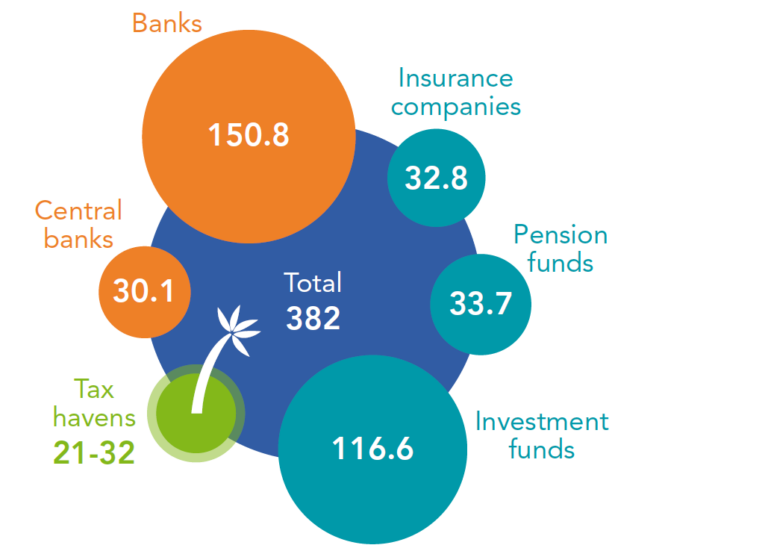

Many corporations have been able to borrow money and issue bonds even if they were hardly creditworthy, or not at all (‘junk bonds’). Investors eagerly bought risky bonds because of their relatively high interest rates. Not only banks have engaged in risky lending but also non-banks with far fewer buffers to face non-performing loans. Total corporate debt rose to $ 13.5 trillion at the end of 2019, which is ‘more than twice the amount in December 2008’. Non-repayment of this debt when the economy goes into recession will send shockwaves(opens in new window) through the financial sector. Because of the interconnections in the financial system, the global debt pile of government, household and corporate debt(opens in new window) , estimated at more than $ 253 trillion at the end of 2019, could dangerously unravel and affect the economy.

The asset managing investment fund industry rapidly grew to more than $ 66.4 trillion under management in 2019,(opens in new window) in close connection with the financial markets. Well-known investment funds are ‘passive’, that is, they just follow financial markets’ movements by using indexes. Recent fund growth came from integrating risky corporate and government bonds. Popular (passive) exchange traded funds (ETFs) have shares that can be bought and sold immediately on exchanges. Thus, when prices fall on stock markets, fund and ETF share prices drop, and investors massively sell them off.

Warning experts

Experts(opens in new window) have been warning that investment fund managers will have to sell even more of the millions of shares and (government and/or corporate) bonds they are collectively holding, exhausting their reserves and worsening the interconnected downward price spiral to irrationally low prices. An overlooked aspect is that investment fund managers have over the years been pressing corporations to increase their profits, often at the expense of social and environmental protection and paying taxes. This has resulted in growing inequality and undermined public services, which now impede a social safety net for riding out the coronavirus pandemic.

These risks are already playing a role in the current market sell-offs, but who are the victims? First, long-term investors such as pension funds with (future) pensions of employees and workers. Second, savers who get no interest or who have been advised to put their savings in the financial markets, especially investment funds. Third, personnel at companies that face too high debt burdens and SMEs that have little reserves.

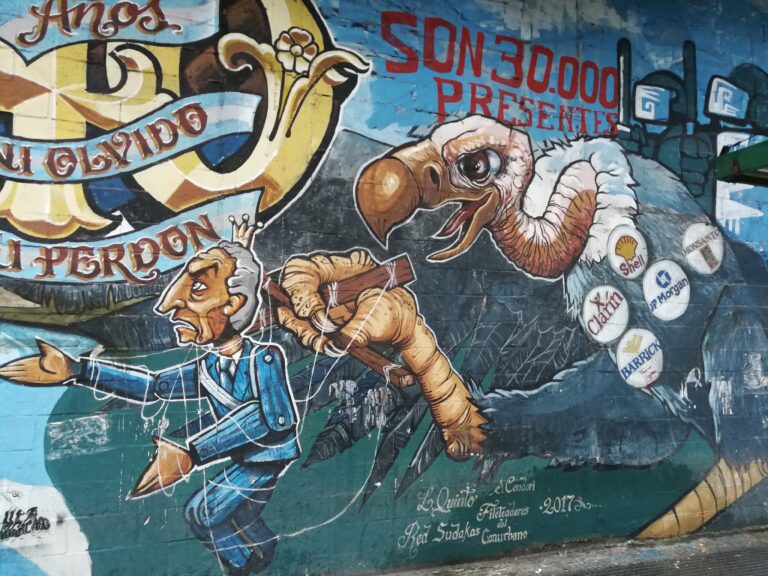

Most of the pain will probably be felt by people in emerging markets and developing countries who already had a large debt burden. These countries now face currency speculation and currency depreciation, lower commodity prices, plummeting financial markets and bond sell-offs due to huge financial outflows by foreign investors. They had attracted risk-taking investors with high interest rate bonds and commitment to free movement of capital. But now, they can hardly defend their currencies with the foreign reserves they have. Argentina, for instance, has seen its peso dropping even further, deteriorating its non-repayable dollar-denominated debt and its huge socio-economic impact. The question is whether the so-called ‘vulture funds’ (mostly hedge funds) are now scooping up developing country bonds at huge discount prices to later sue these countries in court to pay back fully, as happened in the past.

More drastic measures for the financial sector

Interestingly, the Indonesian financial authority took action(opens in new window) by improving rules to halt excessive financial market sell-offs and banning speculation on falling share prices (short selling), which is now also banned in some other countries(opens in new window) ). The US stock markets rose sharply on Friday, 13 March after the US president(opens in new window) announced a national emergency (!) and a financial injection of $ 50 bn. But the subsequent US Central Bank’s rate cuts and buying up of bonds and securities did not calm the global financial markets(opens in new window) . It had not stemmed the fear of problems in the less visible parts of the system(opens in new window) that might lead to a liquidity and credit crunch. Western financial authorities should also take other drastic action: halting high frequency trading, automatic trading and even the whole of panicked trading, as well as banning short selling, securities’ lending and all financial players with purely speculative socially useless activities. While people are stopped from moving, central banks should stop speculative moves and capital flight by smartly introducing capital controls. Worryingly, EU supervisors(opens in new window) have decided to relax the regulations of banks, which are somewhat stricter – i.e. more crisis-resistant – than financial market rules.

Policymakers must protect the public interest. They have failed to coordinate at the start of the financial markets’ herd behaviour following the COVID-19 virus outbreak, notwithstanding high-fanfare G20 and G7 summits in the past. The first feeble joint declarations of the G20 and G7 finance ministers and central bank governors(opens in new window) had no effect. If they would immediately introduce a financial transaction tax, it would slow down speculative excessive trading and would collect huge amounts of money for public coffers.

Corona wealth tax?

Many large investors who sold their shares, bonds or investment funds have put lots of money aside and have cash at hand. In the current circumstances, central bank measures are not a sufficient answer and should not prioritise speculative financial markets. Targeted government action to buttress the economy and society first requires far more financial means. Extraordinary measures should orient idle private money immediately to companies and projects that deal with the health crisis and economic downturn. Financial authorities must make any crisis support conditional on financing those most in need. A Corona wealth tax could finance public services and public support for those hard hit by the crisis (e.g. flex workers, SMEs). The COVID-19 crisis is a lesson and opportunity to swiftly re-engineer and re-regulate the financial industry towards a just and climate-friendly transition of the economy, instead of speculation. The financial industry should serve society when and where it is needed, not disrupt it.

This article was originally published in openDemocracy’s ourEconomy section(opens in new window)

Do you need more information?

-

Myriam Vander Stichele

Senior Researcher

Related content

-

Myriam Vander StichelePosted in category:Publication

Myriam Vander StichelePosted in category:Publication Myriam Vander Stichele

Myriam Vander Stichele

-

Growing investment in developing country bonds problematic for financial stabilityPosted in category:News

Growing investment in developing country bonds problematic for financial stabilityPosted in category:News Myriam Vander StichelePublished on:

Myriam Vander StichelePublished on: -

Benchmarks for climate-friendly investmentsPosted in category:Long read

Benchmarks for climate-friendly investmentsPosted in category:Long read Myriam Vander StichelePublished on:

Myriam Vander StichelePublished on: -

Investor’s disclose of sustainability risksPosted in category:Long read

Investor’s disclose of sustainability risksPosted in category:Long read Myriam Vander StichelePublished on:

Myriam Vander StichelePublished on: -

CSOs are calling for better managing cross-border volatile capital flowsPosted in category:News

CSOs are calling for better managing cross-border volatile capital flowsPosted in category:News Myriam Vander StichelePublished on:

Myriam Vander StichelePublished on: -

Which threats are lurking in the financial sector? Published on:

Myriam Vander StichelePosted in category:Publication

Myriam Vander StichelePosted in category:Publication Myriam Vander Stichele

Myriam Vander Stichele