Free Trade Agreement between the EU and the U.S. threatens the public interest

The United States and the European Union are currently negotiating a Transatlantic Trade and Investment Partnership (TTIP), which includes far-reaching market liberalisation and deregulation provisions. The negotiations are not only on trade and investments, but will have a direct impact on European legislation and regulations.

Much is at stake: what and how consumers can buy, which companies make profits or losses, what kind of employment will stay, food safety and environment regulations. Investors will be able to submit claims worth millions against government measures. SOMO’s work on the TTIP focuses on three crucial aspects: transparency and public accountability, the controversial investment chapter and financial (de)regulation.

Transparency

SOMO activities focus on the lack of democracy and transparency in the TTIP negotiations. The Dutch and the European Parliaments are not party to the negotiations and do not even have a say in whether the negotiations should take place, let alone on the treaty’s provisions. All negotiations take place behind closed doors and gives the preference to the inclusion of business. The closed nature of the negotiations threatens the public interest (Dutch only).

Investment

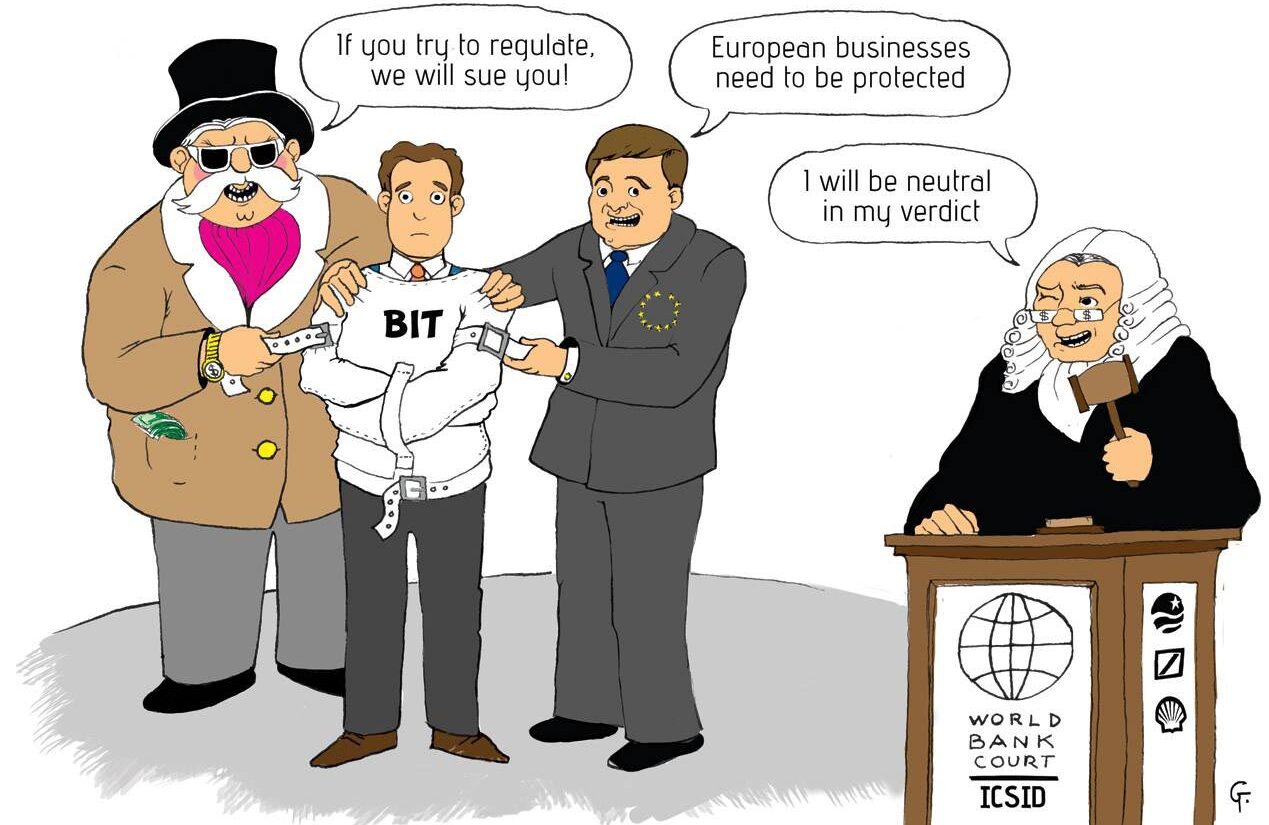

Another controversial aspect of the agreement is the investment chapter. This allows companies to sue national governments if they feel that government measures and laws threaten (future) profitability. In recent years, following previous trade agreements, companies have sued countries all over the world for many billions in response to government legislation on the environment, health, energy and many areas of social interest. After much criticism and under pressure from civil society organisations, negotiations on the investment chapter are now on hold while a public consultation is held. (Click here for the debate that SOMO organised in cooperation with TNI and Real World Economics(opens in new window) ).

Financial deregulation

Finally, SOMO focuses on how the agreement would allow challenges to financial regulations on the grounds that they are barriers to trade. The TTIP will promote the interests of large companies, prejudice the interests of citizens, consumers and parliaments and threaten the sovereignty of states. In recent years, SOMO has conducted research that has clearly shown the dangers of deregulation for financial stability and a sound financial sector.

SOMO’s work on the TTIP fits within a broader vision of fair trade rules in which trade is at the service of society rather than the other way round. In the Netherlands and in Europe, SOMO works on these issues with the Seattle to Brussels network and the Alternative Trade Mandate.

Related news

-

CSDDD Datahub reveals law covers fewer than 3,400 EU-based corporate groupsPosted in category:News

CSDDD Datahub reveals law covers fewer than 3,400 EU-based corporate groupsPosted in category:News David Ollivier de LethPublished on:

David Ollivier de LethPublished on: -

Additional evidence filed against Booking.com for profiting from illegal settlementsPosted in category:News

Additional evidence filed against Booking.com for profiting from illegal settlementsPosted in category:News Lydia de LeeuwPublished on:

Lydia de LeeuwPublished on: -

The hidden human costs linked to global supply chains in ChinaPosted in category:News

The hidden human costs linked to global supply chains in ChinaPosted in category:News Joshua RosenzweigPublished on:

Joshua RosenzweigPublished on: