Hidden profits

The EU’s role in supporting an unjust tax system 2014

This report – the second in a series of three annual reports – brings together civil society organisations (CSOs) in 15 countries across the EU. Experts in each CSO have examined their national governments’ commitments and actions towards combatting tax dodging and ensuring transparency. This year, for the first time, each country is also directly compared with its fellow EU member states on four critical issues: the fairness of their tax treaties with developing countries; their willingness to put an end to anonymous shell companies and trusts; their support for increasing the transparency of economic activities and tax payments of transnational companies; and their attitude towards letting the poorest countries get a seat at the table when global tax standards are negotiated. This report doesn’t only cover national policies, but also governments’ positions on existing and upcoming EU-level laws and global reform proposals.

Partners

Publication

Accompanying documents

Related content

-

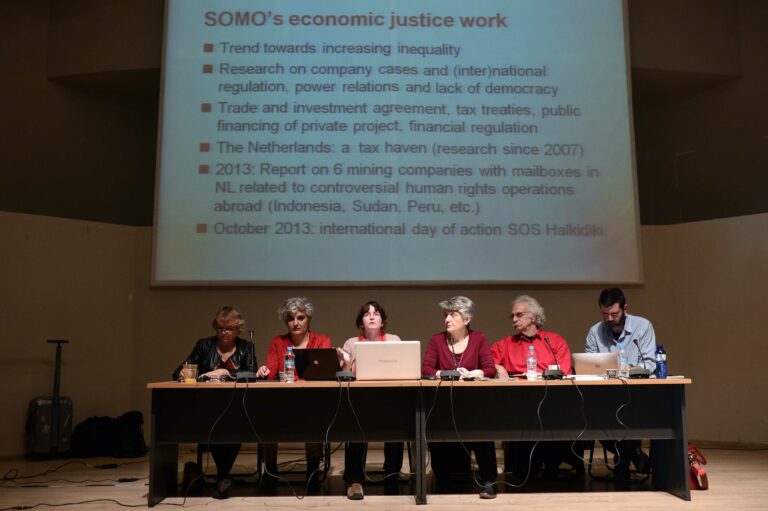

The Netherlands: A tax haven? Published on:F. WeyzigPosted in category:PublicationF. Weyzig

-

-

-

Fifty shades of tax dodging Published on:

Indra RömgensPosted in category:Publication

Indra RömgensPosted in category:Publication Indra Römgens

Indra Römgens

-

-

The Netherlands lags further behind in tackling tax avoidancePosted in category:NewsPublished on:

The Netherlands lags further behind in tackling tax avoidancePosted in category:NewsPublished on: -

-

F. WeyzigPosted in category:PublicationF. Weyzig

-