Keep watching

The tax avoidance structures of ViacomCBS

ViacomCBS, a self-described “fundamental content company”, reaches about 700 million consumers in more than 180 countries around the world with its media content. About 24% of the company’s total revenue stems from content licensing outside the North American market. Through the shifting of IP licensing rights from country to country, ViacomCBS has been able to avoid paying billions of dollars in taxes in several countries.

Media companies like Disney, Netflix and ViacomCBS produce digital content such as television shows, movies and subscription channels. All of these intangible “goods” are protected by intellectual property rights (IPs), and they are represented as intangible assets on the balance sheet.

By nature, intangible assets are easily relocated from one jurisdiction to another. This means that companies that rely on intangible assets can easily shift a large part of their global profits to tax havens, where most of their profits remain untaxed. As this report will show, the international rules for the taxation of multinational companies have not been adjusted to the economics of value creation through intangible assets.

US$4 billion in tax avoidance

For almost two decades, ViacomCBS has been using the Netherlands to avoid paying corporate income tax in the United States. From 2002 onwards, this multinational mass media conglomerate has been sublicensing its television rights to third parties and consumers outside the North American market via the Netherlands. In total, at least US$32.5 billion in revenues has been collected by the company’s Dutch subsidiaries during the period 2002-2019.

Through this conduit construction with the Netherlands, the company has managed to avoid US corporate income tax payments totalling $1.46 billion (for CBS Corporation) and an estimated $2.5 billion (for Viacom). Furthermore, due to the sale of IP licensing rights via low-tax jurisdictions and non-taxed entities, the UK government is expected to lose an estimated $365 million (through Viacom’s IP sale) and $855 million (through CBS Corporation’s IP sale) in corporate income tax.

By analysing the company’s annual reports, SOMO was able to ascertain that the Dutch government provided ViacomCBS with so-called ‘rulings’ as far back as 2002. Through these rulings, the Dutch government has ensured that only a small part (since 2011 specifically referred to as 0.8%) of the billed revenues of ViacomCBS subsidiaries in the Netherlands have been subject to taxation there. These rulings have given the media conglomerate the legal certainty that their revenue collected in the Netherlands will only be marginally taxed there. In this way, the incorporation of conduit subsidiaries in the Netherlands has made it possible for ViacomCBS to create international tax schemes that leave billions of dollars of the company’s revenues untaxed.

Publication

Related content

-

Failed Dutch tax policy must lead to reconsiderationPosted in category:Opinion

Arnold MerkiesPublished on:

Arnold MerkiesPublished on: Arnold Merkies

Arnold Merkies -

European tax havens help Ukrainian poultry giant to feather its nestPosted in category:News

European tax havens help Ukrainian poultry giant to feather its nestPosted in category:News Vincent KiezebrinkPublished on:

Vincent KiezebrinkPublished on: -

A fox in the henhouse Published on:

Vincent KiezebrinkPosted in category:Publication

Vincent KiezebrinkPosted in category:Publication Vincent Kiezebrink

Vincent Kiezebrink -

-

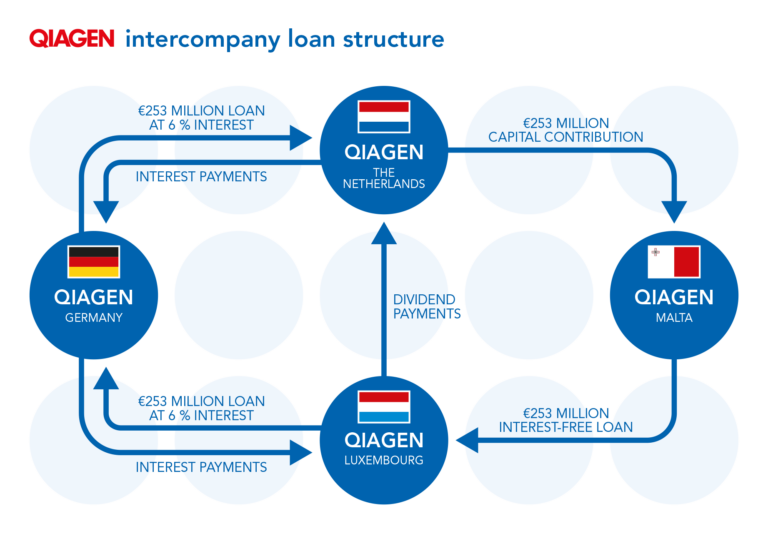

New research reveals large-scale tax avoidance by coronavirus test manufacturer QiagenPosted in category:NewsPublished on:

New research reveals large-scale tax avoidance by coronavirus test manufacturer QiagenPosted in category:NewsPublished on: -

How tax havens like the Netherlands are draining developing countries of precious public fundsPosted in category:Opinion

Maarten HietlandPublished on:

Maarten HietlandPublished on: Maarten Hietland

Maarten Hietland -

Maarten HietlandPosted in category:Publication

Maarten HietlandPosted in category:Publication Maarten Hietland

Maarten Hietland

-

-

Maarten HietlandPosted in category:Publication

Maarten HietlandPosted in category:Publication Maarten Hietland

Maarten Hietland

-

The Indonesia-Netherlands tax treaty is one of Indonesia’s biggest tax leaksPosted in category:News

The Indonesia-Netherlands tax treaty is one of Indonesia’s biggest tax leaksPosted in category:News Maarten HietlandPublished on:

Maarten HietlandPublished on: -

-

The Netherlands – still a tax haven Published on:

Arnold MerkiesPosted in category:Publication

Arnold MerkiesPosted in category:Publication Arnold Merkies

Arnold Merkies