Challenging the ‘Growth at all costs’ model

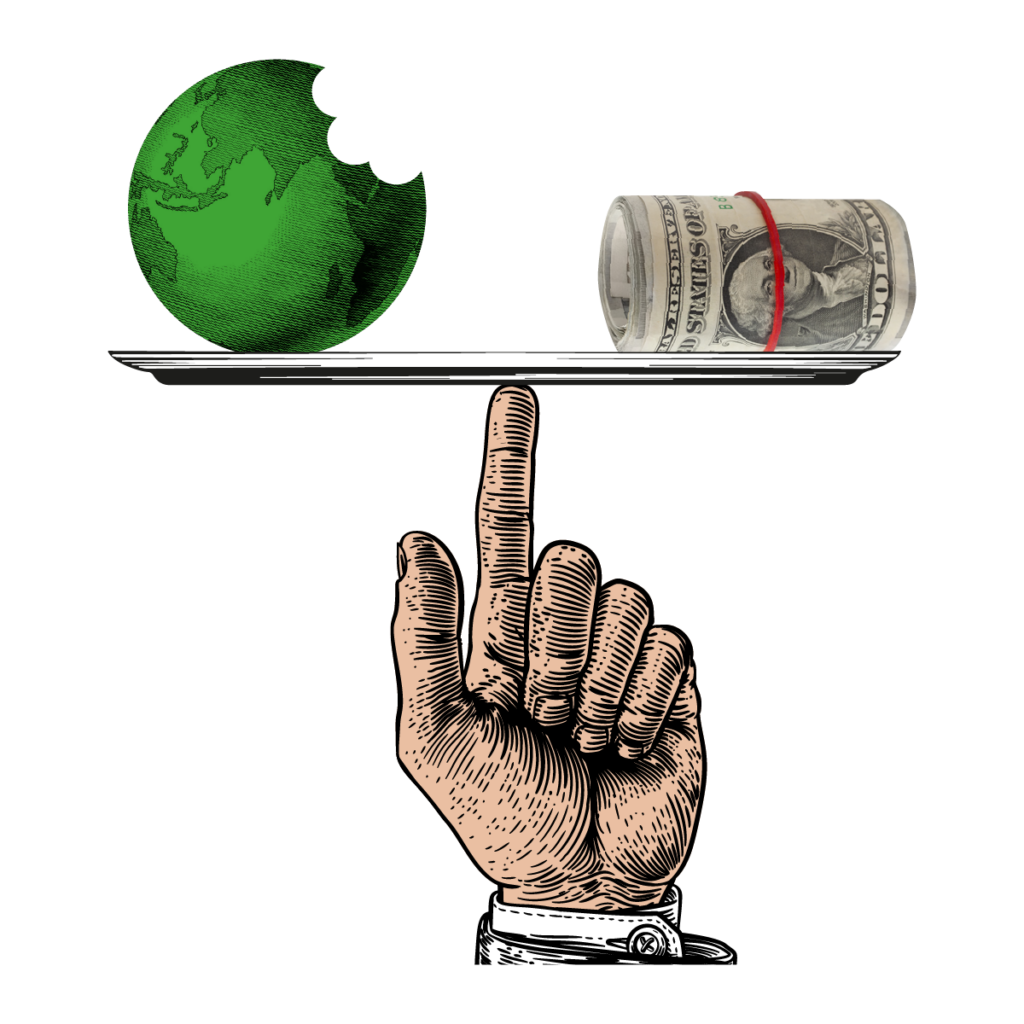

The ‘growth at all costs’ mindset profoundly shapes the behaviour of multinational corporations and governmental strategies worldwide. However, this approach – which maximises shareholder profit at the expense of people and planet – goes against global sustainability goals and contributes to the growing inequality within and between countries.

At SOMO, we are challenging the pursuit towards boundless growth and we are championing more sustainable alternatives to trade and investment structures.

For more than 50 years, a specific and limited interpretation of a company’s purpose and function has held sway in the business world. Under the current system, a corporation’s primary mission is to optimise value for its shareholders. Company directors are responsible for making sure that this objective is realised at all costs. Put simply, the core rationale for a company’s existence boils down to generating profits for shareholders – a view that has been strongly supported by stakeholders including hedge funds and asset managers.

At the organisational level, this perspective has prompted the adoption of harmful tactics to attract investors, such as share buybacks and excessive dividend payments. These are often funded by debt, alongside aggressive tax avoidance practices.

The unrelenting pursuit of maximising shareholder value and earnings for every single share frequently involves cost-cutting measures and an exclusive focus on growth. The avoidance of corporate taxes exacerbates global disparities by shifting the tax burden onto workers, consumers, and small enterprises.

To make matters worse, governments are championing swift resource extraction and high levels of consumerism as they strive for economic expansion. This competitive growth framework bolsters existing disparities and sustains the economic benefits gained through colonialism.

Our work and research address the human and climate consequences of this ‘growth at all costs’ model – from unfair trading practices to tax avoidance schemes and their impacts on the planet.

Jump to

- Tackling dominant narratives and myths

- Fighting tax avoidance from multinational corporations

- Exposing mergers and acquisitions in Big Tech

- Improving the liability of complex corporate structures

- Challenging profits in the pharmaceutical sector

- Promoting decarbonisation and climate justice

- Challenging unfair practices in the food and agriculture industry

- Making the financial sector serve people and the planet

Highlighted Publications

-

Amazon’s European chokehold Published on:

Margarida SilvaPosted in category:Publication

Margarida SilvaPosted in category:Publication Margarida Silva

Margarida Silva

-

Fintech’s red flags Published on:

Myriam Vander StichelePosted in category:Publication

Myriam Vander StichelePosted in category:Publication Myriam Vander Stichele

Myriam Vander Stichele

-

Pharma’s pandemic profits Published on:

Esther de HaanPosted in category:Publication

Esther de HaanPosted in category:Publication Esther de Haan

Esther de Haan

Growth at all costs: tackling dominant narratives and myths

The transformations needed in climate action, human rights, and social equity will continue to be eroded as long as share value, dividend distributions, and earnings per share continue to serve as the primary benchmarks for investors’ perceptions of companies. Likewise, unless the prevailing notion of ‘economic growth’ is changed, meaningful progress will remain out of reach.

Societal ideas about who holds power and how that power is used are embedded in and supported by these narratives. A clear illustration of this is the idea that nations should cultivate an investor-friendly environment by providing various tax incentives to corporations, allegedly benefiting their citizens. However, substantial evidence indicates that tax incentives are not necessary to attract investment and often result in increased inequality both within and between countries.

The imperative to rebalance power dynamics hinges on transforming these dominant narratives.

Narratives and myths that attempt to undermine alternative perspectives are at the heart of the existing economic system. Governments find themselves trapped in the grip of multinational enterprises and shareholder-driven rationale. Meanwhile policymakers have internalised corporate viewpoints regarding the most effective strategies for the economy and society. These dynamics are all too clear across an extensive array of issues.

Our work at SOMO focuses on debunking these myths and shifting narratives to unlock new alternatives. We do this through our own research and by pushing for regulations in various sectors, as illustrated below.

Fighting tax avoidance from multinational corporations

Companies that focus on a ‘growth at all costs’ strategy are prioritising the maximisation of their profits to fuel expansion and growth. Companies often use tax treaties to dodge their tax responsibilities. In addition, multinational corporations intricately weave networks of shell companies in tax havens across the globe, often manipulating profits and sidestepping their tax commitments.

SOMO is dedicated to uncovering companies’ tax avoidance manoeuvres and shedding light on the repercussions of these actions on human rights and public welfare. Our research reveals how the prevailing economic and financial structure sustains economic disparities and amplifies the imbalance between the corporate domain and civil society.

Exposing mergers and acquisitions in Big Tech

Companies often engage in mergers and acquisitions to increase their market share quickly or to diversify their offerings in pursuit of rapid growth. In particular, Big Tech corporations have grown exponentially by focusing on growth and scale at all costs under a ‘winner takes all’ logic.

Big Tech companies can take over emerging competitors, acquire innovative technology and know-how, and expand into various business sectors – from health to education to food distribution.

SOMO is working with partners globally to reform the rules and strengthen their enforcement to safeguard against the impact of Big Tech on wider society.

Improving the liability of complex corporate structures

Companies driven by aggressive growth objectives create complex corporate structures involving subsidiaries, affiliates, and offshore entities. Complex corporate structures use different legal principles and complex supply chains to limit liability and to dilute corporate responsibility.

For example, they use separate legal personalities to avoid liability, as well as outsourcing and subcontracting to shift the burden of corporate responsibility to third parties.

Our goal at SOMO is to ensure that the final corporate beneficiaries are legally liable for the negative impacts of their business across the value chain.

Challenging profits in the pharmaceutical sector

Pharmaceutical corporations amass billions in annual profits, frequently relying on public funds for the research and development of new drugs. Many of their earnings are directed towards dividends and share buybacks for stakeholders, rather than being channelled into further research.

Our investigations at SOMO into the globe’s 27 largest pharmaceutical companies have unveiled a troubling trend: over the past two decades, more money has been invested in financial activities than in medicine production and research.

Borrowed funds often deviate from investments in innovative drug development or increasing production capacity. Instead, these funds have predominantly been allocated to dividend distributions and the acquisition of corporate shares.

At SOMO, we are calling for a medical system that prioritises the health of people above financial profit.

Promoting decarbonisation and climate justice

The relentless pursuit of boosting shareholder value poses a significant obstacle when it comes to addressing the climate crisis. Amid the energy transition, major oil, coal, and gas companies worldwide remain steadfast in their allegiance to ‘maximising shareholder value’ by continuing to invest in fossil fuels, emit carbon, damage ecosystems and violate human rights in the process.

While renewable energy resources are pivotal in achieving decarbonisation goals, it is vital to acknowledge their finite availability and scalability. Research at SOMO has shown that the current model for an ‘energy transition’ relies on the same model of extraction as the previous carbon-intensive model but simply changes the minerals that are being extracted.

Here at SOMO, we believe a genuine commitment to decarbonisation demands a deeper exploration that extends beyond superficial dialogues and fundamentally challenges the underlying capitalist principle of ‘growth at all costs’.

Challenging unfair practices in the food and agriculture industry

The food and agriculture industry has considerable adverse effects on ecology, climate, and biodiversity due to various food production, distribution, and consumption practices.

We strive to promote equitable and sustainable food production and consumption by conducting extensive research, engaging in advocacy efforts, and collaborating with partners and networks globally to make sure that food production is fairer for people everywhere.

Making the financial sector serve people and the planet

The growth and size of various globally operating banks and institutional investors – including asset managers, private pension funds, and insurance companies – have rendered them a systemic threat.

They have grown to a point where their failure could trigger severe consequences, and their interconnections are so great that their mismanagement can lead to taxpayer-funded bailouts – notwithstanding existing regulations to prevent such situations.

At SOMO, our research exposes the diverse range of financial actors, products, tools, channels, and behaviours that both directly and indirectly fund actions that are detrimental to communities, workers, and citizens – and that contribute to climate change.

Our investigations monitor and reveal potential sources of financial risk and impending crises, while advocating for safeguards to protect people, societies, and the planet from financial misconduct.

Do you need more information?

-

Jasper van Teeffelen

Researcher

Latest updates

-

Civil society organisations push for transformative global investment rulesPosted in category:News

Civil society organisations push for transformative global investment rulesPosted in category:News Bart-Jaap VerbeekPublished on:

Bart-Jaap VerbeekPublished on: -

-

Kenya terminates Bilateral Investment Treaty with the NetherlandsPosted in category:News

Kenya terminates Bilateral Investment Treaty with the NetherlandsPosted in category:News Bart-Jaap VerbeekPublished on:

Bart-Jaap VerbeekPublished on:

Related Topics

Discover more of SOMO’s work and publications.