Mapping Tax-free investments

New interactive website shows which European countries facilitate tax dodging through mailbox companies

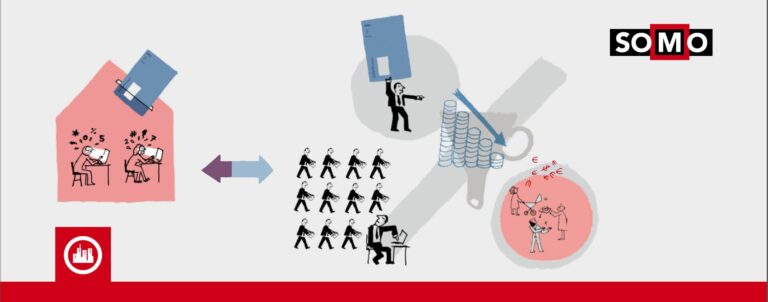

SOMO has developed a new story that visualises bilateral investments of European countries. A new comparison between UNCTAD and IMF data illustrates the scale of tax avoidance through mailbox companies and selected tax havens.

Which country is the biggest investor worldwide, the US or the Netherlands? How big is the percentage of mailbox company-related investments in Greece or the US? If mailboxes are an indication of tax dodging, which countries pay the bill? This story provides you with the answers in the form of interactive maps and allows you to download the underlying data.

Once again, the Netherlands can claim the dubious title of ‘Biggest Investor in the World’. Total outgoing investments of the Netherlands exceed those of Germany, France and the UK combined. On paper, the Dutch are the biggest investors in Turkey and the second biggest in Indonesia – right after Singapore. However, these are not investments made by Dutch companies, but by corporations and investors residing in other countries who use Dutch mailbox companies for tax-related purposes. The vast majority of direct investments (more than 80%) from the Netherlands to the world is therefore routed through mailbox companies.

Many research reports in recent years have shown how large corporations use mailboxes in conduit economies to shift profits and avoid paying taxes in the countries where their actual economic activities take place. The relative size of the mailbox company sector in any given country points to the fact that a country is being used as a tax conduit, or as a tax haven. Consequently, a country that receives most of its foreign investments from mailbox companies abroad will suffer tax revenue losses.

The data shows that investments among countries are unequally distributed and tend to concentrate in particular countries with relatively small economies. The maps illustrate the sheer volume of investment related to mailbox companies in the Netherlands, Luxembourg, Austria and Hungary. Until now, these are the only countries that disclose mailbox-related investment data. And even this data is incomplete, because many bilateral investment positions are not disclosed. The lack of data is a major barrier to the fight against international tax avoidance.

Governments worldwide, and the Netherlands is no exception, claim to be tackling tax-dodging by multinational companies. If this is the case, their efforts have been inadequate, or have clearly not had the right kind of impact. Governments need to increase financial transparency, to allow public scrutiny the impact tax avoidance on public finances by citizens, politicians, journalists, and civil society organisations.

All countries should be obliged to collect and publish mailbox company-related data. Also, corporations should be obliged to report financial data for every country they operate in, including profit and loss statements, turnover figures, number of employees, and corporate income taxes.

Related content

-

Tax-free profits Published on:

Roos van OsPosted in category:Publication

Roos van OsPosted in category:Publication Roos van Os

Roos van Os

-

-

-

-

Fifty shades of tax dodging Published on:

Indra RömgensPosted in category:Publication

Indra RömgensPosted in category:Publication Indra Römgens

Indra Römgens