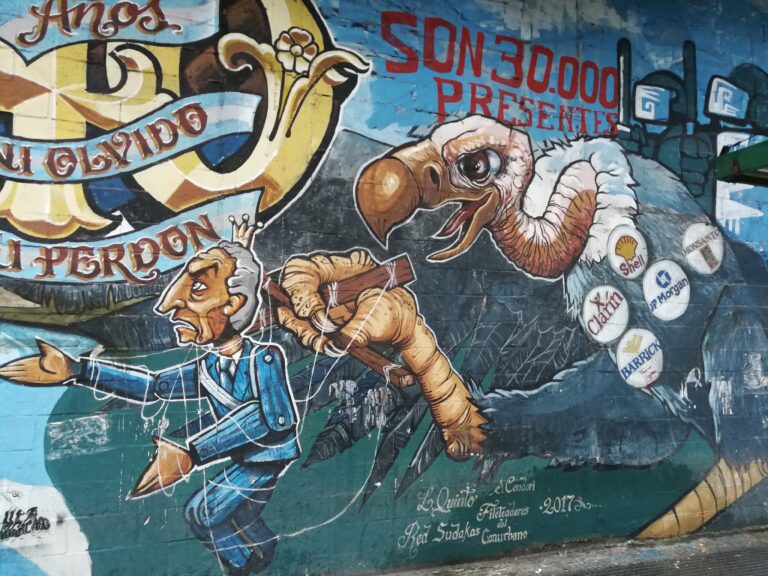

Powerful financial industry lobby group frustrates structural debt relief for poorest countries

As the world’s poorest countries face dangerously high debt burdens, a powerful global interest group of the financial industry, the International Institute of Finance (IIF), frustrates structural debt relief initiatives by the G20. This is the main finding of a new SOMO report The IIF & debt relief. How the Institute of International Finance lobbies to prevent private debt relief for developing countries.

“The IIF uses its long time privileged access to the G20 and debtor countries to successfully argue against private creditor participation in the G20 debt service suspension initiative (DSSI),” says SOMO researcher Myriam Vander Stichele.

“The result is that the poorest countries repaid US$ 14.9 billion to private creditors between May 2020 and June 2021, while that money could have been spent fighting the Covid-19 pandemic and climate change.”

The IIF is the biggest interest association of the global financial industry with more than 450 members from more than 70 countries. Among IIF members are commercial banks, asset managers, hedge funds, and a few central banks active in debt markets. As the G20’s private sector partner, G20 finance ministers asked the IIF to involve private creditors in the G20 structural debt relief initiative.

“But the IIF has used influential lobbying strategies and private standards to frustrate such demands from the public sector”, says Vander Stichele.

Importantly, the IIF has recently argued fiercely in favor of enhancing a private debt market to finance sustainable development and climate change mitigation. Not coincidentally, it actively supports scaling up a very profitable sustainable finance industry. This will transfer even more money from poorer countries to global financial conglomerates and their wealthy clients.

The report concludes with recommendations to redress the current skewed relationships between on the one side the IIF and private creditors, and on the other side, public international and national financial decision-makers, parliamentarians, citizens, and other stakeholders.

SOMO publishes its report during the Global Days of Action for Justice and Debt Cancellation(opens in new window) . More than 600 organisations and movements worldwide are calling on the World Bank, the IMF, and all private and public debt holders to unconditionally cancel debt to “all countries in need” and for a “fair, transparent binding and multilateral framework for debt crisis resolution that addresses unsustainable and illegitimate debt”.

Do you need more information?

-

Myriam Vander Stichele

Senior Researcher

Related content

-

The IIF & debt relief Published on:

Myriam Vander StichelePosted in category:Publication

Myriam Vander StichelePosted in category:Publication Myriam Vander Stichele

Myriam Vander Stichele

-

Will the G20 let private finance escape debt relief once again?Posted in category:Long read

Will the G20 let private finance escape debt relief once again?Posted in category:Long read Myriam Vander StichelePublished on:

Myriam Vander StichelePublished on: -

Why the IIF is unlikely to help poor countries with debt reliefPosted in category:Opinion

Myriam Vander StichelePublished on:

Myriam Vander StichelePublished on: Myriam Vander Stichele

Myriam Vander Stichele -

Myriam Vander StichelePosted in category:Publication

Myriam Vander StichelePosted in category:Publication Myriam Vander Stichele

Myriam Vander Stichele

-

Debt crisis alert. End of Quantitative Easing poses grave risks for emerging economiesPosted in category:News

Debt crisis alert. End of Quantitative Easing poses grave risks for emerging economiesPosted in category:News Rodrigo FernandezPublished on:

Rodrigo FernandezPublished on: