Stop tax avoidance in Europe

The European Elections were dominated by the question of whether there should be more or less Europe. However, responses to a questionnaire sent out to political parties by Tax Justice NL indicate that most parties agree on one thing: tax avoidance is a prominent subject that needs to be tackled at a European level. In the years to come, the EU can make a real difference.

This article has been published in Dutch on the Oneworld website.(opens in new window)

Tax avoidance has lots of negative implications. Multinational corporations and wealthy individuals make use of the loopholes in the international tax system in order to pay very little or no tax at all. Currently, according to Eurostat calculations, companies in the Netherlands do not pay the official corporation tax rate of 25% but actually pay just 7% on average. That is a huge difference compared with other countries. This is not only unfair to EU citizens who are having to live with severe cuts and increased financial burdens and yet still pay their full share of taxation, it is also unfair to citizens in developing countries. The EU member states implement incoherent – and therefore ineffective – policies. Causing developing countries to receivedevelopment funding on the one hand, but on the other hand losing out on billions because multinationals channel their profits through European tax havens such as the Netherlands, Ireland and Luxembourg.

More transparency

Fortunately, in the coming five years, our MEPs will be able to do something about this. It is for this reason that, in the run up to the elections, Tax Justice NL handed out a list of recommendations to all political parties. Among those parties that completed the questionnaire and returned it are the Socialist Party (SP), D66, Christian Democrat Appeal (CDA), the Party for the Animals (PvdD), the Labour Party (Partij van de Arbeid), Green Left (Groen Links), 50Plus and the Pirate Party. The VVD (People’s Party for Freedom and Democracy) gave no response. The answers have revealed that all parties that responded are in favour of greater transparency. This is very encouraging, because confidentiality and anonymity make it impossible to expose damaging tax structures. Futhermore all parties want multinationals to report on their profits and turnover, taxes paid and report the number of people employed in each country where they operate. At the moment this is not mandatory for all multinationals but the political parties have indicated that they will at least support these measures over the coming years.

Transparency is essential but more is needed if we are aiming for a fair tax system in the future. Not all political parties are willing to go quite as far. For instance, Tax Justice NL supports a general anti-abuse measure that will prevent mailbox companies without employees to claim tax benefits. After all, fictitious people are not allowed to make use of mortgage relief, so why should fictitious companies be able to receive tax reliefs? the CDA however prefers to stick to the anti-abuse legislation currently in force in the Netherlands, which, incidentally, is almost never actually enforced.

Scrap the right to veto

The current system encourages a race to the bottom with countries vying to have the lowest possible tax rates. What is ultimately required is a review of the current tax system so that a company pays its fair share of tax in every country, according to its economic presence there. Dutch Parties have strongly differing opinions about this as it would require an international harmonisation of the tax base. Parties such as the Party for the Animals disagree because they feel that tax is a matter for the member states themselves. Green Left are calling for the abolishment of a country’s veto right on cross-border tax legislation. For most parties this is a step too far. Green Left, the Labour Party and the Socialist Party however support the introduction of a minimum corporation tax rate in order to call a halt to the race to the bottom.

Time for action

If we examine and compare the answers, we are able to conclude that the Dutch MEP candidates really do intend to join their European colleagues in Parliament in tackling tax avoidance by multinationals over the next five years. However, it is not just about promises made before the elections; more importantly it’s about the action that is taken over the next five years. The MEPs still have to prove themselves and unfortunately we have seen that in the past when it comes down to it, many succumb to the pressure of multinationals and national government coalitions. Whatever happens, Tax Justice NL will be keeping its finger on the pulse.

For a list of all the responses, visit the Tax Justice NL website(opens in new window) (Dutch only).

Tax Justice

Tax Justice NL is a network of nine Dutch civil society organisations: Oxfam Novib, Oikos, SOMO, Cordaid, Both Ends, Max van der Stoel Foundation, Transnational Institute, Action Aid and ICCO.

Partners

Related content

-

-

-

Big Companies, Low Rates Published on:

Indra RömgensPosted in category:Publication

Indra RömgensPosted in category:Publication Indra Römgens

Indra Römgens

-

-

-

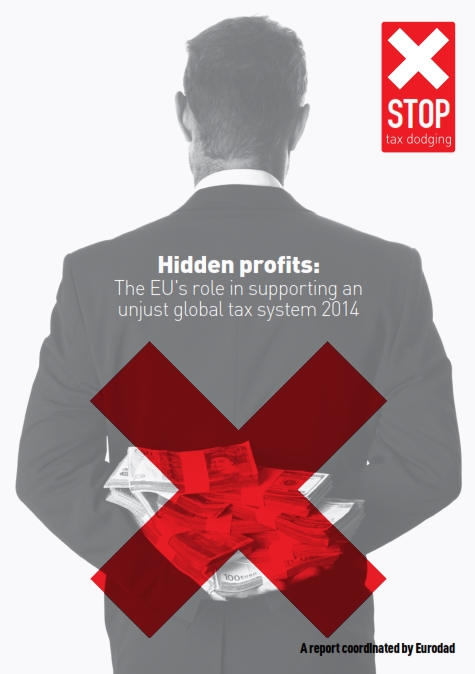

Hidden profits Published on:

Indra RömgensPosted in category:Publication

Indra RömgensPosted in category:Publication Indra Römgens

Indra Römgens

-

-

-

Fifty shades of tax dodging Published on:

Indra RömgensPosted in category:Publication

Indra RömgensPosted in category:Publication Indra Römgens

Indra Römgens

-

The treaty trap: The miners Published on:

Vincent KiezebrinkPosted in category:Publication

Vincent KiezebrinkPosted in category:Publication Vincent Kiezebrink

Vincent Kiezebrink