Financialisation

Financialisation is the term for non-financial corporations engaging in financial transactions – such as investing, increasing debt for strategic reasons, buying back their own shares and buying out potential competitors – to create higher shareholder value in the short term. This has been happening in numerous sectors - from pharma and electronics to big tech. Financialisation can create huge social cost. SOMO investigates different sectors where financialisation is happening and problematises the consequences.

Overview of articles

-

Shareholder remuneration up by 500% in 20 yearsPosted in category:News

Shareholder remuneration up by 500% in 20 yearsPosted in category:News Rodrigo FernandezPublished on:

Rodrigo FernandezPublished on: -

Shareholders first Published on:

Rodrigo FernandezPosted in category:Publication

Rodrigo FernandezPosted in category:Publication Rodrigo Fernandez

Rodrigo Fernandez

-

Pay and the pandemic Published on:

Rodrigo FernandezPosted in category:Publication

Rodrigo FernandezPosted in category:Publication Rodrigo Fernandez

Rodrigo Fernandez

-

CEO salaries rise sharply despite corona crisisPosted in category:News

CEO salaries rise sharply despite corona crisisPosted in category:News Rodrigo FernandezPublished on:

Rodrigo FernandezPublished on: -

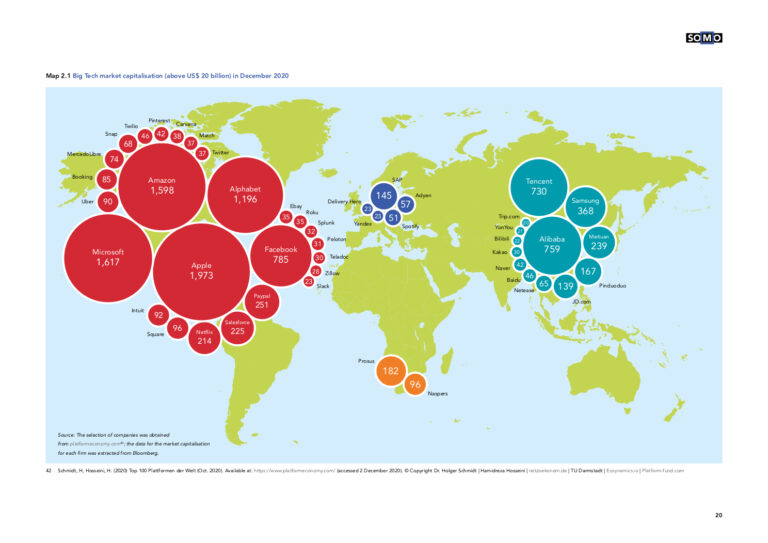

COVID-19 pandemic accelerates the monopoly position of Big Tech companiesPosted in category:News

COVID-19 pandemic accelerates the monopoly position of Big Tech companiesPosted in category:News Rodrigo FernandezPublished on:

Rodrigo FernandezPublished on: -

The financialisation of Big Tech Published on:

Rodrigo FernandezPosted in category:Publication

Rodrigo FernandezPosted in category:Publication Rodrigo Fernandez

Rodrigo Fernandez

-

The earnings model of the pharmaceutical industry needs to be overhauledPublished on:Posted in category:Opinion

-

Private gains we can ill afford Published on:

Rodrigo FernandezPosted in category:Publication

Rodrigo FernandezPosted in category:Publication Rodrigo Fernandez

Rodrigo Fernandez

-

SOMO reveals the financialisation of the pharmaceutical industry and the potentially deadly costsPosted in category:NewsPublished on:

SOMO reveals the financialisation of the pharmaceutical industry and the potentially deadly costsPosted in category:NewsPublished on: