Tax

Governments need tax revenue to provide public goods and services like education, health care and infrastructure. Large corporations, like citizens, benefit from these goods and services. But many avoid paying their fair share of taxes. Corporate tax avoidance shifts the tax burden to workers, consumers and small companies, contributing to global economic inequality and stunting economic and social development. Governments like the Netherlands deprive developing countries of sorely-needed tax revenue by facilitating tax avoidance through mailbox companies. More and more countries compete for the most appealing system of corporate tax-dodging. It’s a system that privatises gains while socialising losses. SOMO exposes the aggressive tax avoidance strategies of companies, and the impacts of tax avoidance on human rights and public interests. We examine the international and national tax regimes that facilitate corporate tax avoidance, with special attention to the role of the Netherlands as a leading tax haven.

Overview of articles

-

-

Week of action against mining company Rio TintoPosted in category:News

Week of action against mining company Rio TintoPosted in category:News Rhodante AhlersPublished on:

Rhodante AhlersPublished on: -

Failed Dutch tax policy must lead to reconsiderationPosted in category:Opinion

Arnold MerkiesPublished on:

Arnold MerkiesPublished on: Arnold Merkies

Arnold Merkies -

-

European tax havens help Ukrainian poultry giant to feather its nestPosted in category:News

European tax havens help Ukrainian poultry giant to feather its nestPosted in category:News Vincent KiezebrinkPublished on:

Vincent KiezebrinkPublished on: -

A fox in the henhouse Published on:

Vincent KiezebrinkPosted in category:Publication

Vincent KiezebrinkPosted in category:Publication Vincent Kiezebrink

Vincent Kiezebrink -

Tax training on the (global) digital economyPosted in category:News

Tax training on the (global) digital economyPosted in category:News Maarten HietlandPublished on:

Maarten HietlandPublished on: -

-

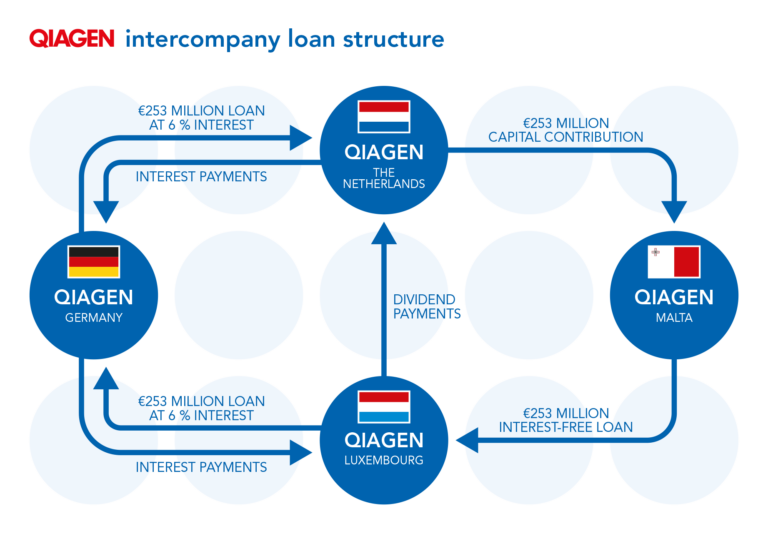

New research reveals large-scale tax avoidance by coronavirus test manufacturer QiagenPosted in category:NewsPublished on:

New research reveals large-scale tax avoidance by coronavirus test manufacturer QiagenPosted in category:NewsPublished on: -

Profiting from a pandemic Published on:

Vincent KiezebrinkPosted in category:Publication

Vincent KiezebrinkPosted in category:Publication Vincent Kiezebrink

Vincent Kiezebrink -

How tax havens like the Netherlands are draining developing countries of precious public fundsPosted in category:Opinion

Maarten HietlandPublished on:

Maarten HietlandPublished on: Maarten Hietland

Maarten Hietland -

Dutch tax treaty policy differs considerably from practice regarding developing countriesPosted in category:News

Dutch tax treaty policy differs considerably from practice regarding developing countriesPosted in category:News Maarten HietlandPublished on:

Maarten HietlandPublished on: -

Maarten HietlandPosted in category:Publication

Maarten HietlandPosted in category:Publication Maarten Hietland

Maarten Hietland

-

-

G4S company scan Published on:

David Ollivier de LethPosted in category:Publication

David Ollivier de LethPosted in category:Publication David Ollivier de Leth

David Ollivier de Leth -

-

Rio Tinto Shareholders: your dividends are plundered bounty from MongoliaPosted in category:Opinion

Rhodante AhlersPublished on:

Rhodante AhlersPublished on: Rhodante Ahlers

Rhodante Ahlers -