Tax

Governments need tax revenue to provide public goods and services like education, health care and infrastructure. Large corporations, like citizens, benefit from these goods and services. But many avoid paying their fair share of taxes. Corporate tax avoidance shifts the tax burden to workers, consumers and small companies, contributing to global economic inequality and stunting economic and social development. Governments like the Netherlands deprive developing countries of sorely-needed tax revenue by facilitating tax avoidance through mailbox companies. More and more countries compete for the most appealing system of corporate tax-dodging. It’s a system that privatises gains while socialising losses. SOMO exposes the aggressive tax avoidance strategies of companies, and the impacts of tax avoidance on human rights and public interests. We examine the international and national tax regimes that facilitate corporate tax avoidance, with special attention to the role of the Netherlands as a leading tax haven.

Overview of articles

-

TTIP threatens the ability to enforce fair taxes on corporations, according to new researchPosted in category:NewsPublished on:

TTIP threatens the ability to enforce fair taxes on corporations, according to new researchPosted in category:NewsPublished on: -

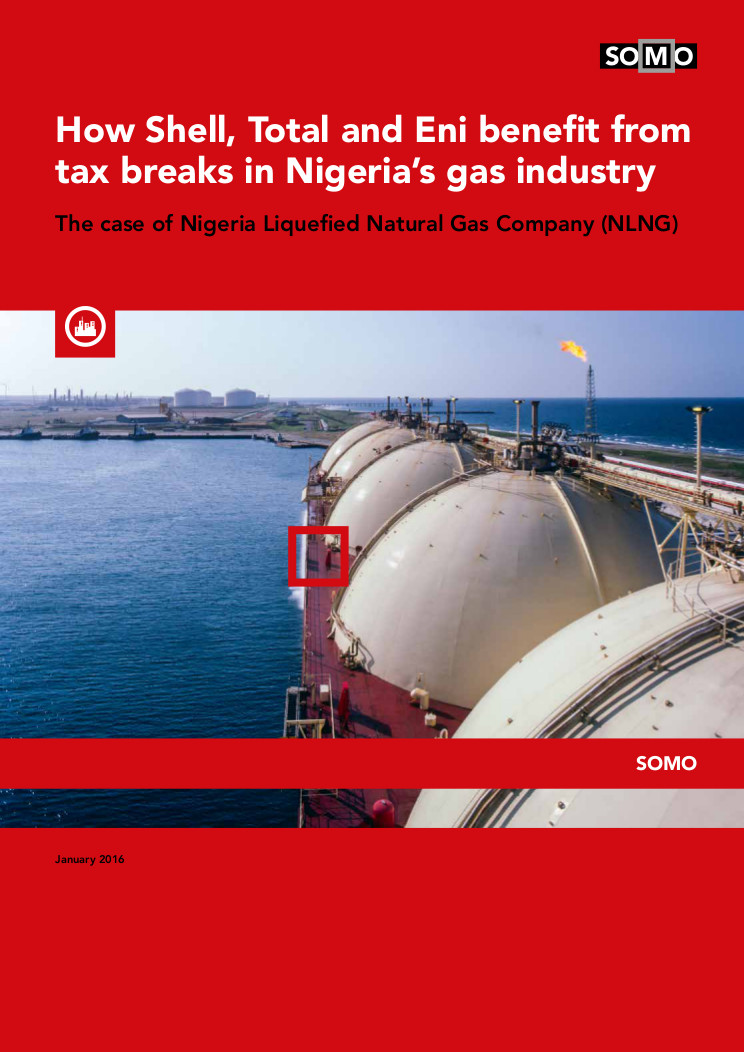

ActionAid and SOMO reveal billion dollar tax break benefiting Shell, Total and EniPosted in category:NewsPublished on:

ActionAid and SOMO reveal billion dollar tax break benefiting Shell, Total and EniPosted in category:NewsPublished on: -

-

Mark van DorpPosted in category:Publication

Mark van DorpPosted in category:Publication Mark van Dorp

Mark van Dorp

-

-

-

Tax-free profits Published on:

Roos van OsPosted in category:Publication

Roos van OsPosted in category:Publication Roos van Os

Roos van Os

-

A year after Luxleaks, most EU countries still fail to tackle tax dodgingPosted in category:NewsPublished on:

A year after Luxleaks, most EU countries still fail to tackle tax dodgingPosted in category:NewsPublished on: -

-

-

Fifty shades of tax dodging Published on:

Indra RömgensPosted in category:Publication

Indra RömgensPosted in category:Publication Indra Römgens

Indra Römgens

-

-

The Netherlands lags further behind in tackling tax avoidancePosted in category:NewsPublished on:

The Netherlands lags further behind in tackling tax avoidancePosted in category:NewsPublished on: -

Crisis-ridden Greece hit by tax avoidance through the NetherlandsPosted in category:NewsPublished on:

Crisis-ridden Greece hit by tax avoidance through the NetherlandsPosted in category:NewsPublished on: -

-

-

-

Fool’s Gold (Eldorado Gold) Published on:

Roos van OsPosted in category:Publication

Roos van OsPosted in category:Publication Roos van Os

Roos van Os