Tax avoidance: everything you need to know

Tax avoidance has been in the news a great deal lately – and especially now, in the run-up to the Lower House Parliamentary elections. Nearly every political party has included something about it in its programme. For this reason, we have compiled this factsheet with everything you need to know about tax avoidance.

What is tax avoidance?

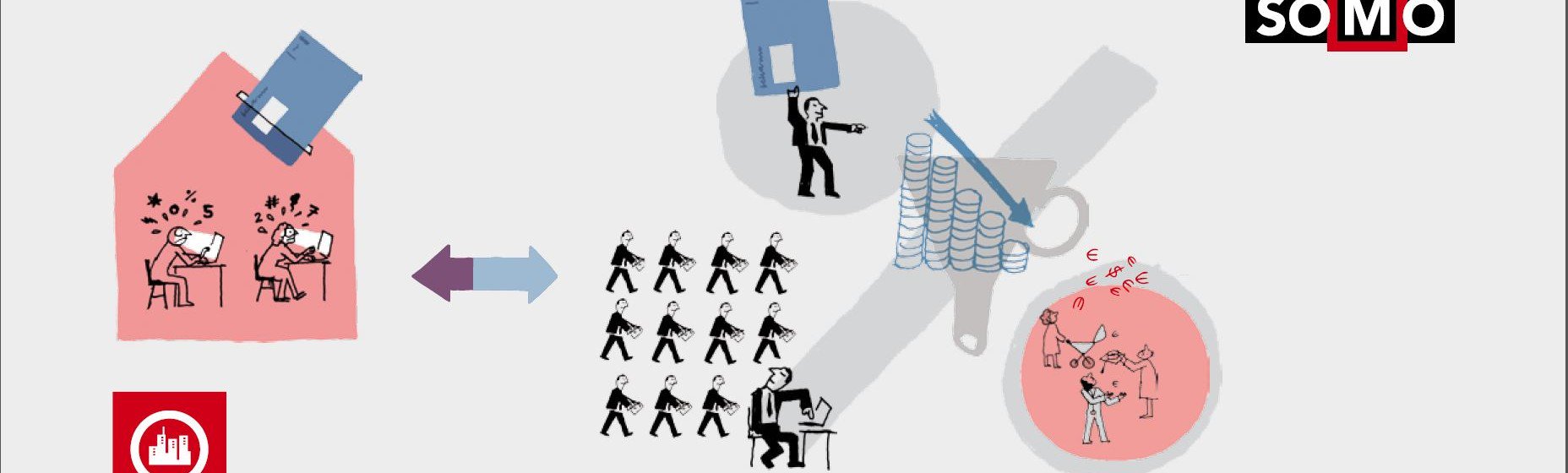

Take a moment to view this video about how tax avoidance works.

This content is available after accepting the cookies.

View on Youtube. Opens in a new window

The problem

For years, SOMO has been carrying out research into how multinationals avoid paying tax, and the damaging consequences this has for governments and Dutch citizens that miss out on that tax revenue. These are tax revenues that are meant for funding schools, hospitals and infrastructure.

Citizens foot the bill

Due to multinationals’ tax avoidance, the tax burden is shifted to employees, consumers and small businesses. When large companies thus have the opportunity to avoid paying taxes, small and medium-sized businesses and salaried employees are left to pay the bill. This increases economic inequality and hinders economic and social development.

Costs

The European Commission estimates the amount of tax revenue that we miss out on annually due to tax fraud, tax evasion and tax avoidance at € 1,000 billion per year. That is more than the combined total of what all EU countries spend on healthcare annually. And €150 billion of this so-called “tax loophole” can be directly linked to tax avoidance. Read more here about which countries are involved and where the money goes.

Increasing pressure

Efforts in recent decades to bring about structural reforms in the international tax system have often been blocked by key EU member states, including the Netherlands. However, the political landscape is shifting. Due to campaigns including those by the regional and international Tax Justice networks, and since the beginning of the financial crisis in 2007, public indignation and pressure for a fair economic redistribution has been increasing. These are essential for structural reforms of both the Dutch and international tax systems.

The role of the Netherlands

The Netherlands often figures prominently in our research studies because it plays a crucial part in many types of avoidance constructions for the international business community. The Netherlands is the world’s second-largest investor, after the US; nearly 80 per cent of this revenue flows through letterbox companies. The Dutch government stimulates and facilitates this flow, making it extremely easy to set up constructions to channel money through the Netherlands and thus to avoid and evade taxes. Recently SOMO, commissioned by FNV (the Netherlands trade union confederation), researched and reported on the tax practices of major Dutch companies in “Big Companies, Low Rates”.

Human rights and impunity for letterbox companies

Tax avoidance results in human casualties. For this reason, SOMO researched human rights violations by companies with letterbox companies in the Netherlands. A research report from 2013, “Private Gain, Public Loss”, examined human rights, eight large multinationals in the raw materials sector and the lack of adequate mechanisms for holding them accountable. The report concluded that the Dutch state fails to sufficiently regulate foreign companies that are linked to Dutch letterbox companies.

Portugal

But it is not just the Dutch government that loses out on tax revenues. In 2013, we published a research study into tax avoidance in Portugal, where the country is suffering from austerity measures. What was discovered? The Netherlands is Portugal’s largest fiscal leak: Dutch letterbox companies provide a financial hub for gaining tax advantages.

Greece

Another country suffering from harsh austerity measures is Greece. While billions were loaned to Greece under extremely strict terms, bringing major social and economic consequences for the Greek people, Greece’s economic recovery was undermined by tax avoidance via letterbox companies in the Netherlands. “The European Union and the Netherlands apply a double standard. On the one hand, they imposed harsh austerity measures on Greece, with devastating social and economic impacts. But on the other hand, they actively facilitated tax avoidance, which cost the Greek government millions of euros”, stated SOMO researcher Katrin McGauran, who worked on our case study of 2015 into tax avoidance by the Eldorado Gold mining company, which operates in Greece.

The Netherlands refuses to address tax avoidance

“The Netherlands is not prepared to give up its own ‘crown jewels’, such as the participation exemption. The European Commission also rightfully stated that the Netherlands has one of the most destructive tax codes in the EU”, said SOMO researcher Jasper van Teeffelen as part of a large-scale investigation on tax avoidance in Europe in 2016. “In comparison with last year, the EU, chaired by the Netherlands, has taken steps to combat tax avoidance, but the Netherlands has done little to address its own role as facilitator of this tax avoidance.”

Pressure from corporate interests

Regarding tax measures and agreements, however, the Dutch government is under great pressure from corporate interests. SOMO has investigated how far this influence from the corporate world reaches by means of Freedom of Information requests (Wob-verzoeken). A reconstruction of the influence of the VNO-NCW (Confederation of Netherlands Industry and Employers) in introducing a new tax measure shows how public funds are harnessed for private interests.

Solutions

On 5 April 2016, Dutch Minister of Finance Jeroen Dijsselbloem stated in the Dutch newspaper Financieel Dagblad that the Netherlands is too often “used” by companies to avoid paying taxes and is thus part of the problem. But how can a solution be devised? Dutch TV broadcaster RTL Nieuws interviewed SOMO to answer this precise question. And at the end of last year, Tax Justice Nederland published a paper which proposed concrete solutions.

Since the Netherlands is a major transfer port for businesses, the Dutch government should take measures to end tax avoidance and evasion via its fiscal regime. Specifically, the Netherlands should take the following measures:

More transparency:

- Governments must require businesses to publish financialreports in each country where they do business. This so-called country-by-country reporting would make it possible to assess whether companies have (real, economic) activities in various countries, how much revenue they generate there and where they pay taxes. This reporting must also provide insight into transactions that take place within the company group – thus, between group entities – because this is where the greatest tax avoidance has been observed.

- A public register of ultimate beneficial owners. The Panama Papers clearly showed the risks of the fact that little is often known about the people behind complex corporate structures – those who ultimately receive the profit. A public register of these ultimate beneficial owners is an important step.

Put an end to the Netherlands as a country for channelling funds:

- Within a European context, the Netherlands must levy tax on money channelled through tax havens. For example, the Netherlands currently has no withholding tax on interest and royalty flows. This must be changed.

- Letterbox companies must no longer be permitted to operate. This means stricter substance requirements that reflect real economic activities, and better anti-abuse clauses in national legislation to ensure that artificial constructions can make no claim on tax advantages. Read the European Commission recommendation on aggressive tax planning.

Elections

Tax avoidance is included in the programmes of most Dutch political parties. The MVO Platform (CSR network of civil society organisations and trade unions) has created an online voting advice tool to compare the ambitions of Dutch political parties in the area of tax avoidance. VVD (People’s Party for Freedom and Democracy), PVV (Party for Freedom) and 50 Plus rate worst on this subject, while GroenLinks (Green Party) and Partij voor de Dieren (Party for the Animals) score the highest.

Later this week, (Sunday, 12 February) a pre-election debate will be held at the De Balie in Amsterdam on Dutch tax policy: Make Tax Fair Again. What is the Netherlands’ role in an international strategy to combat tax avoidance? Will measures be taken on the European level to address tax avoidance or have we become entangled in an international ‘race-to-the-bottom’? Who are the real winners and losers in national and international tax politics? Tickets are currently still available.

Read more

Fact sheets and websites

Continuing tax avoidance undermines European solidarity. The Netherlands must do its utmost on this subject to maintain credibility as EU chair.

Tax-free investments identified: A new, interactive website shows which European countries facilitate tax avoidance via letterbox companies.

Video

From SOMO: ‘Cash machine’ Apple creates poor societies.(opens in new window)

Columns and articles

- Tax avoidance and letterbox companies: the figures and the consequences

- The Netherlands is paradise for thieves and dictators. Op-ed which previously appeared in De Volkskrant Dutch newspaper

Other organisations that address tax avoidance:

- Tax Justice Nederland(opens in new window)

- Global Alliance for Tax Justice(opens in new window)

- Eurodad(opens in new window)

Do you need more information?

-

Jasper van Teeffelen

Researcher

Partners

Related news

-

The Netherlands – still a tax haven Published on:

Arnold MerkiesPosted in category:Publication

Arnold MerkiesPosted in category:Publication Arnold Merkies

Arnold Merkies

-

Tax avoidance in Mozambique’s extractive industriesPosted in category:Long read

Tax avoidance in Mozambique’s extractive industriesPosted in category:Long read Vincent KiezebrinkPublished on:

Vincent KiezebrinkPublished on: -

The treaty trap: The miners Published on:

Vincent KiezebrinkPosted in category:Publication

Vincent KiezebrinkPosted in category:Publication Vincent Kiezebrink

Vincent Kiezebrink