Challenging the Food and Agriculture Industry

Global food and agriculture systems are essential to nutrition, employment, culture, and stability but also gravely unjust and unsustainable. Giant companies dominate global food and feed supply chains, dictating how farmers produce and what consumers put on their plates. Their monopoly power enables them to rake in giant profits off the cost-of-living crisis and climate chaos.

Through research and advocacy with partners and networks worldwide, SOMO pushes for regulation that curbs corporate power and fosters equitable and sustainable agrifood systems worldwide.

The food supply chains in the EU are plagued by human rights violations, land grabs, deforestation, pollution, and negative impacts on biodiversity and the climate. Non-state actors such as civil society organizations, trade unions, journalists, and academics are crucial in exposing injustices in global value chains and creating laws to ensure respect for human rights and the environment in EU supply chains.

Our efforts show that the problems lie with the big multinationals that dominate supply chains and dictate prices and processes. Together with partners, we show the unequal power relations in the food supply chains and examine which tools can be used to break that power.

SOMO is part of a growing group of NGOs that focus on antitrust and competition law as a tool to break up giant food companies, changing the narrative around monopoly power and convincing policymakers that the growing dominance of only a handful of companies in the food supply chain needs to be broken.

Highlighted Publications

-

Hungry for profits Published on:

Vincent KiezebrinkPosted in category:Publication

Vincent KiezebrinkPosted in category:Publication Vincent Kiezebrink

Vincent Kiezebrink

-

Bitter brew Published on:Posted in category:Publication

-

Transparency for fairer and greener EU supply chains Published on:

Sanne van der WalPosted in category:Publication

Sanne van der WalPosted in category:Publication Sanne van der Wal

Sanne van der Wal

Controlling mergers and acquisitions with agricultural commodity traders

As people all over the world struggle with hunger and ever-rising costs of living, the five largest agricultural commodity traders have announced their biggest profits ever. Together, ADM, Bunge, Cargill, COFCO, and Louis Dreyfuss Company (ABCCD) hold a monopoly position on the global market for staples like grain, corn, soy, and sugar. This enables them to influence pricing and costs, resulting in excessive profits and fueling inflation, according to SOMO’s report “Hungry for Profits“.

In 2022, the profits of the ABCCD tripled compared to the 2016-2020 period. The Big Five control between 70 and 90 per cent of the global trade in commercial grains and exert a high level of control on the main export markets of soy in Brazil, the United States, Paraguay, and Argentina. They maintain this powerful position in the food supply chain due to a vast network of contracted agricultural suppliers, storage, processing (crushing), and transportation in core strategic food-producing countries or regions. On 1 August 2024, the European Commission approved the next big merger between the global agricultural traders Bunge and Viterra. This deal is unprecedented in size and will move the new company closer to the size of ADM and Cargill.

-

Download: A new merger wave in the agri-food value chain? Some reflections on the Bunge/Viterra merger (pdf, 2.23 MB)

High economic concentration in the agribusiness sector allows dominant firms to control large segments of the market, potentially leading to higher prices and reduced competition. This high economic concentration can also lead to less resilient and sustainable food systems.

Our work argues that proactive merger control is necessary to secure consumers’ well-being, ensure fair distribution of value across the food value chain to incentivize and diffuse innovation, and address issues related to economic democracy, food security, and sovereignty. Furthermore, SOMO asserts that the massive merger between Bunge and Viterra should have been subject to further investigation, and an analysis commissioned by SOMO shows all the reasons why the European Commission should have gone deeper.

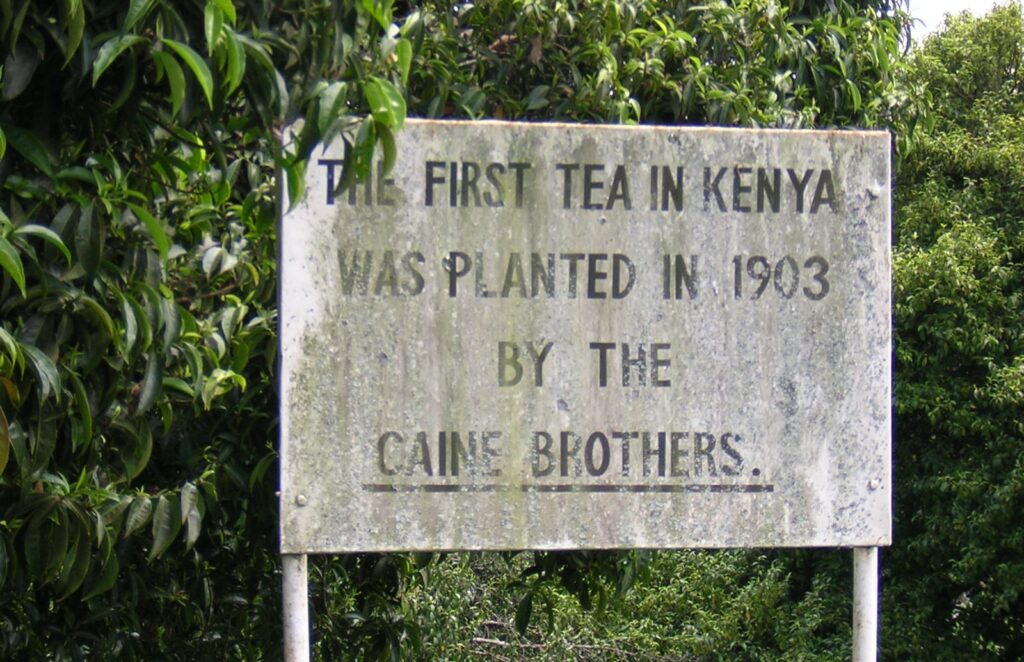

For transparent supply chains

EU supply chains in general are riddled with human rights violations, land grabs, deforestation, pollution, and adverse biodiversity and climate impacts. We are pushing for regulation, policies, and practices that ensure decent work and sustainability – including legally enforceable corporate accountability mechanisms, and a leading role for workers in monitoring and improving workplace conditions.

A new look at monopoly power and competition policy in the agricultural business

Over the past decade, we have witnessed an extraordinary expansion of market concentration across most sectors of the economy, including Big Agri and supermarkets. The top four companies in any given sector now hold a larger market share than 10 years ago.

This rise in market concentration results in a broad range of harms, from negative impacts on consumers to corporate capture of regulators and excessive payouts to shareholders. Even though these issues make headlines, attention to the structural nature of the market concentration problem remains very limited. The recent cost-of-living crisis is a case in point.

The competition policy toolkit is notably under-utilised. Take the EU for example: since the start of the EU Merger Regulation in 1990, only 88 out of 9243 notified mergers have been stopped. That is less than 1 per cent. Sixty cases that European regulators considered – and approved – involved the ABCCD agricultural commodity traders, including the 34-billion-dollar deal between agricultural giants Bunge and Viterra.

The failures of competition policy to prevent and address growing market concentration reflect a longstanding narrow approach to this policy domain, and an inability to properly consider the cumulative impacts of mergers. This is becoming painfully clear in our food supply chain. Competition regulators should step up their efforts to rein in harmful market dominance by supermarkets and Big Agri like the ABCCDs.

EU Union Customs Code: ambitions and challenges

EU member states’ customs authorities are currently responsible for taxing goods crossing EU borders and preventing illegal or unsafe products from entering or leaving the common market. However, there is a proposal to expand their responsibilities to include enforcing legislation on issues such as deforestation and human rights violations in supply chains. The European Commission aims to reform the Union Customs Code (UCC), which is the EU’s legal framework for customs, to better equip customs for their current and future work, considering the challenges they already face.

In May 2023, the European Commission proposed a new UCC, which includes the establishment of a new EU customs authority and an EU trade information hub. These institutions are intended to improve coordination, information collection, and risk management through a more centralized approach. However, SOMO’s work has shown how the proposal does not address the key feature needed for the UCC to contribute most effectively to making EU supply chains more just and sustainable: transparency. Through various policy recommendations, SOMO calls for improvements in supply chain transparency.

Do you need more information?

-

Sanne van der Wal

Senior Researcher

Latest updates

-

-

Modern slavery is still lurking in your coffee cupPosted in category:News

Modern slavery is still lurking in your coffee cupPosted in category:News Joseph Wilde-RamsingPublished on:

Joseph Wilde-RamsingPublished on: -

Unilever under UN investigation for denying remedy to victims of violence at its plantationPosted in category:News

Unilever under UN investigation for denying remedy to victims of violence at its plantationPosted in category:News Lydia de LeeuwPublished on:

Lydia de LeeuwPublished on:

Related Topics

Discover more of SOMO’s work and publications.